- HYPE coin 7.75% surge highlights strong liquidity inflows, with resistance ahead at $52 and support near $50.

- LINK climbed 3.91% as trading volume doubled, signaling renewed demand for oracle-driven blockchain applications.

- HBAR rose 3.34% with a 58% jump in volume, aiming for $0.24 while holding strong support at $0.22.

Altcoins delivered strong performances as Hyperliquid crossed $50, Chainlink regained momentum, and Hedera advanced with higher volume. Each token showed distinct drivers of growth and liquidity, strengthening the broader sentiment across the altcoin market. Renewed participation highlighted short-term resilience while technical levels provided critical points for continuation.

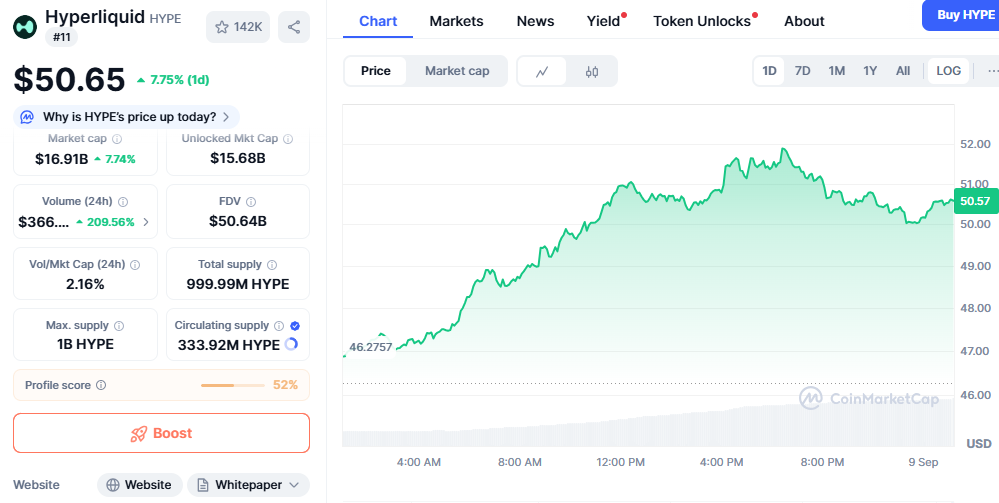

Hyperliquid Maintains Upside Momentum

Hyperliquid traded at $50.65 after gaining 7.75 percent in a single day. The market cap reached $16.91 billion with trading volume at $366 million, surging by over 209 percent. The token’s sharp liquidity inflows pushed prices decisively above the $50 psychological threshold.

Source: CoinMarketcap

The fully diluted valuation stood at $50.64 billion, showing the token’s long-term potential tied to its supply structure. The unlocked market cap was reported at $15.68 billion, supporting strong liquidity conditions. Circulating supply remained 333.92 million out of the 1 billion maximum cap, favoring balanced growth dynamics.

Resistance is visible near $52, while support sits between $49 and $50. A continuation above current levels could extend the rally further. However, any break under $50 may invite corrective action as profit-taking builds pressure.

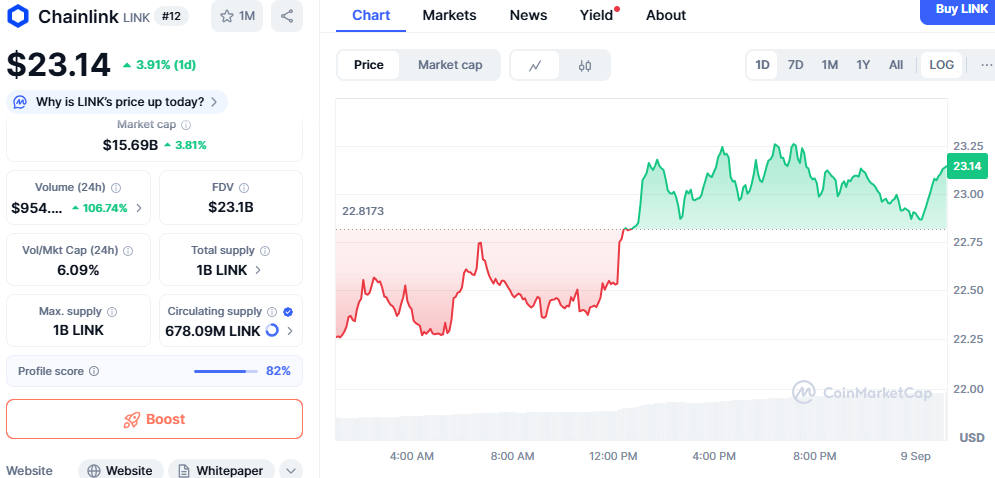

Chainlink Regains Traction

Chainlink traded at $23.14 with a 3.91 percent increase over the last 24 hours. Its market cap stood at $15.69 billion, while trading volume rose above $954 million, reflecting a 106 percent surge. The increase in activity highlighted growing demand tied to the utility of decentralized oracle services.

Source: CoinMarketcap

The token’s fully diluted valuation was $23.1 billion, consistent with its capped supply of 1 billion LINK. Circulating supply reached 678.09 million LINK, reflecting strong availability in the market. Liquidity remained firm with a volume-to-market cap ratio above six percent, supporting active intraday participation.

Technical indicators show resistance near $23.50, while support is located around $22.80. Sustaining price levels above $23 strengthens the bullish outlook. Recent rebounds indicate that Chainlink continues to stabilize after weeks of consolidation.

Hedera Pushes Higher With Rising Volume

Hedera traded at $0.2264, recording a 3.34 percent daily gain. Its market cap stood at $9.59 billion, while unlocked market cap remained close at $9.63 billion. Daily trading volume surged by 58 percent to $228.9 million, highlighting stronger participation.

Source: CoinMarketcap

Hedera carries a total supply of 50 billion HBAR with 42.39 billion circulating. Its fully diluted valuation was $11.32 billion, placing it among mid-cap altcoins. Limited inflationary pressure has strengthened sentiment toward its enterprise-focused blockchain use cases.

Resistance has formed around $0.23 to $0.235, while support sits near $0.22. Sustained momentum could push targets toward $0.24 in the short term. Failure to remain above $0.22, however, risks pulling the price back into consolidation.

Earn more PRC tokens by sharing this post. Copy and paste the URL below and share to friends, when they click and visit Parrot Coin website you earn: https://parrotcoin.net0

PRC Comment Policy

Your comments MUST BE constructive with vivid and clear suggestion relating to the post.

Your comments MUST NOT be less than 5 words.

Do NOT in any way copy/duplicate or transmit another members comment and paste to earn. Members who indulge themselves copying and duplicating comments, their earnings would be wiped out totally as a warning and Account deactivated if the user continue the act.

Parrot Coin does not pay for exclamatory comments Such as hahaha, nice one, wow, congrats, lmao, lol, etc are strictly forbidden and disallowed. Kindly adhere to this rule.

Constructive REPLY to comments is allowed