Donald Trump’s getting back in the White House, and the legendary Arthur Hayes is calling it: this is the end of the road for the U.S. dollar.

In his latest essay, Arthur says Trump’s return will turn the American economy into a state-run machine, stripping capitalism down to a husk. “It’s American Capitalism with Chinese Characteristics,” he believes, humorously drawing a vivid comparison with China’s own blend of socialism and free-market control.

Arthur doesn’t just see this as any regular shift in policy but as a full-blown pivot to what he calls a “command economy.” He likens Trump’s approach to that of China’s late leader Deng Xiaoping, who famously said, “It doesn’t matter if a cat is black or white, as long as it catches mice.”

From free-market dreams to the state-controlled machine

According to Arthur, Trump is here to wield power by any means that keep the machine moving. He thinks America left capitalism in the rearview mirror a long time ago. Capitalism, he says, was supposed to mean taking risks, and yes, facing consequences for bad decisions. But that’s not what’s been happening.

“America stopped being purely capitalist in the early 19th century,” Arthur says. And he’s got the dates to back it up. By 1913, the creation of the Federal Reserve outlawed real capitalism. Since then, privatized gains and socialized losses have been the game.

Now Trump’s here to take this game to new heights. Arthur points out that Trump has no issue with printing money like there’s no tomorrow. He reminds us of Trump’s 2020-2021 stimulus frenzy, where the U.S. printed a jaw-dropping 40% of all existing dollars in just two years. That’s no small amount.

And the effect? An economy pumped full of cash, while the structural issues, Arthur insists, remain ignored. “Trump started the stimmie check party,” Arthur reminds us. Biden may have kept it going, but this trend of easy cash handouts was Trump’s brainchild.

Arthur explains how these stimulus checks were just the beginning. With Trump back in office, Arthur anticipates we’re in for another round of “QE for poor people on steroids.”

Trickle-down economics takes its final breath

Back in the day, Arthur says, American policy was a mixed bag of capitalism, socialism, and everything in between. But the elites? They didn’t care. They just wanted to stay on top. For them, it didn’t matter what -ism they were technically under, as long as their power was intact. Arthur makes it clear: the rich never really lost.

When they failed, the government bailed them out, and the bill went straight to the public. “Capitalism means that the rich lose money when they make bad decisions,” Arthur says, adding, “That was outlawed as early as 1913.”

Fast forward to the 2020 COVID pandemic, and Trump’s handling of the crisis became the final nail in capitalism’s coffin, as Arthur sees it. Forget “trickle-down” economics; Trump threw it all out and went straight for the direct-to-public handouts.

The irony? It sort of worked… well for a while at least. Arthur describes how, between 2020 and 2022, Treasury departments under both Trump and Biden issued debt to the Federal Reserve, which then used printed dollars to buy that debt.

But instead of going straight to the rich, this cash hit regular bank accounts. The result? People spent. The economy surged. Arthur says, “Economic growth boomed as the velocity of money increased well above one.”

But there’s always a catch. Inflation soon kicked in, and supply couldn’t keep up with demand. “The supply of goods and services didn’t grow as fast as the population’s government debt-funded purchasing power,” Arthur explains.

Inflation soared, and the wealthy, who own most government bonds, watched their returns get wiped out. Then, Fed Chairman Jay Powell stepped in, raising interest rates in 2022 to curb inflation. Powell may have aimed at inflation, but Arthur sees it differently: “The rich fought back by dispatching their white knight,” he writes.

Enter “QE for poor people,” courtesy of Trump

Arthur paints a picture of a Treasury Department ready to go all in on “America First” policies. Scott Bassett, Trump’s rumored pick for Treasury Secretary, has laid out plans that Arthur describes as industrial policy on overdrive.

Bassett’s ideas are eerily reminiscent of China’s own economic playbook: tax credits, subsidies, and cheap financing for companies willing to “re-shore” critical industries to American soil.

Arthur claims this is pure “command economics,” where the government picks and chooses winners. The goal? Push GDP through the roof while ignoring traditional free-market principles. Companies that play along get government tax breaks, financing, and every incentive to keep production inside U.S. borders. The banks will get in on this, too, Arthur says, with Washington suspending restrictions on bank lending, allowing them to lend as freely as they please.

Who wins in this setup? Ordinary workers, at least at first, Arthur suggests. Jobs will grow, wages will rise, and the government will take its cut through corporate taxes. But this victory will be short-lived, he warns.

The losers? Bondholders and savers, as the yield on long-term bonds will lag behind inflation and wage growth. And for those who can’t keep up with rising costs, Arthur predicts a harsh future. “Wage inflation will be the new norm,” he adds.

Arthur’ cheat sheet: Go heavy on Bitcoin and hard assets

Arthur has his own advice for surviving this incoming economic shift. “Every time a bill passes and hands out money to approved industries, buy stocks in those verticals,” he suggests. His recommendation doesn’t stop at stocks, though. Gold and Bitcoin are at the top of his list.

“Obviously, the hierarchy of my portfolio starts with Bitcoin,” he says, with other cryptocurrencies and industry-related company equity following close behind. Arthur isn’t playing around with fiat currency either; he’s keeping just enough cash in a money market fund to cover his American Express bill.

Arthur also outlines his predictions on how Trump’s economic plans will impact the money supply. He refers to the era of 2009 to early 2020 as the “peak of trickle-down economics” when the Fed’s quantitative easing primarily benefited the wealthy.

Wealthy investors poured this Fed-funded cash into assets like stocks, bonds, and real estate, causing asset prices to skyrocket without generating any real economic growth. “Handing out trillions of dollars to financial asset holders increased the debt-to-nominal GDP ratio,” Arthur says.

In a scenario that reads like a financial horror story, Arthur outlines a future where banks can’t create infinite money forever. “They must provision expensive equity against every debt asset they hold,” he writes, pointing to the risk-weighted asset charges banks face. Simply put, there are limits.

And when those limits are hit, Arthur warns that banks will stop lending altogether, potentially triggering a full-scale credit collapse globally.

This is where the Fed steps back in. He predicts a return to infinite quantitative easing, where the Fed steps in to buy up bad loans from banks, effectively giving them an escape route at the expense of the entire economy.

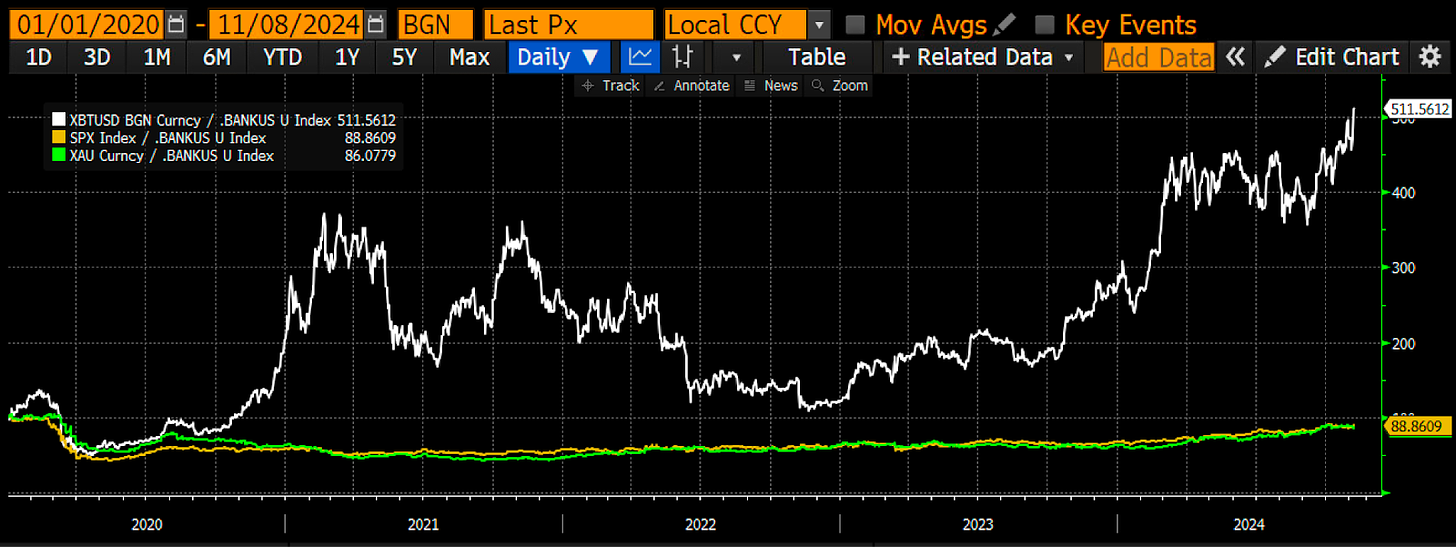

Of the image above, Arthur says:

“This is my custom index that tracks the quantity of US bank credit. In my opinion, this is the most important money supply metric. As you can see, sometimes it leads Bitcoin, like in 2020, and sometimes it lags Bitcoin, like in 2024.”

If this sounds bad, it’s because it is. “The entire population will end up footing the bill due to a debasement of the currency,” he warns.

To cap it all off, the crypto OG comes back to his main point: “Bitcoin is king!”

Earn more PRC tokens by sharing this post. Copy and paste the URL below and share to friends, when they click and visit Parrot Coin website you earn: https://parrotcoin.net0

PRC Comment Policy

Your comments MUST BE constructive with vivid and clear suggestion relating to the post.

Your comments MUST NOT be less than 5 words.

Do NOT in any way copy/duplicate or transmit another members comment and paste to earn. Members who indulge themselves copying and duplicating comments, their earnings would be wiped out totally as a warning and Account deactivated if the user continue the act.

Parrot Coin does not pay for exclamatory comments Such as hahaha, nice one, wow, congrats, lmao, lol, etc are strictly forbidden and disallowed. Kindly adhere to this rule.

Constructive REPLY to comments is allowed