With the Federal Open Market Committee (FOMC) meeting scheduled for today, cryptocurrency markets have entered a cautious phase of price volatility. Bitcoin (BTC), Ethereum (ETH) and XRP are trading in narrow ranges as traders pause for fresh direction from the U.S. central bank, widely expected to hold interest rates unchanged.

The lack of near-term rate move has shifted focus squarely onto the tone and guidance from Fed Chair Jerome Powell. His remarks on inflation, labor markets, and future rate expectations will likely have more impact on sentiment than an unchanged policy rate itself. Markets are reflecting this caution as BTC is consolidating below $90k, ETH is holding near $3k, and XRP remains range bound around $2, unable to sustain decisive upside beyond key resistances.

Bitcoin Price Holds Ground as Traders Await Macro Clarity

Bitcoin’s price action has been devoid of strong directional conviction ahead of the FOMC meeting. Currently, BTC price is hovering around $89,230, replicating a tight range movement. The sideways move reflects broader macro uncertainty. The market is not currently pricing steep rate cuts or hikes, instead it is bracing for Powell’s commentary on the economic outlook and inflation trends.

Bitcoin price is on the edge of a sharp bounce and a break above $90k hurdle with strong volume could reignite broader bullish participation. A break below $85k support could usher in deeper decline ahead.

Ethereum Eyes Key Support as Macro Risk Persists

Ethereum price has shown relative resilience compared to Bitcoin, managing to hold above the $3k support zone. ETH’s consolidation mirrors Bitcoin’s range behavior, with traders opting for defensive positioning rather than aggressive directional bets ahead of the FOMC meeting.

In the last three months, Ethereum has tested multiple times the support zone of $2700 and the resistance zone of $3300. As ETH is at the lower zone of the support, it may showcase a bear trap and could break the upper edge of the zone amidst the volatility ahead. In that case, ETH price breaks $3300 and could push toward $3500, while a break below $2700 may lead to retesting $2500.

XRP Accumulates Near Key Levels as Sentiment Balances

XRP has showcased accumulation near the key demand zone of $1.70-$1.90, but taking a pause amidst indecision among traders ahead of the Fed meeting. Despite recent institutional interest, the token has not broken decisively past the hurdle of $2.40 and retested lower levels, suggesting that broader market risk sentiment remains muted.

However, if XRP price succeeds to break past $2.40, a major upswing toward $3 followed by $3.50 could be seen in the near term. Until XRP maintains its demand zone of $1.70, the bullish structure remains intact.

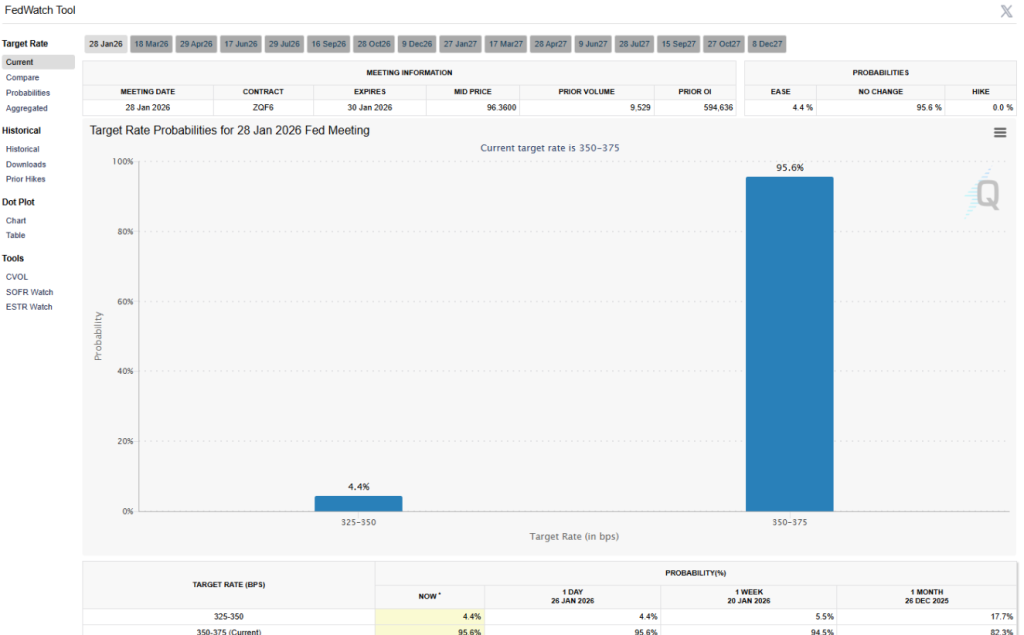

FedWatch Data Confirms Focus on Guidance

According to the CME FedWatch Tool, markets are overwhelmingly pricing in a rate pause at the current range. With the headline decision largely anticipated, attention has shifted away from rates themselves.

Instead, traders are focused on Jerome Powell’s forward guidance. Historically, crypto markets have reacted more sharply to changes in tone than to unchanged policy decisions. This backdrop explains the current compression in volatility across Bitcoin, Ethereum and XRP and remains stable and structurally prepared for volatility once clarity arrives.

FAQs

FOMC meetings impact crypto through Fed guidance; even steady rates can move Bitcoin and altcoins if Powell signals future cuts or risks.

Volatility often rises during Powell’s press conference, not the statement itself. Any surprise tone on inflation risks, labor strength, or timing of cuts can act as a catalyst.

Markets often react again hours later as analysts digest guidance. Treasury yields, the dollar index, and U.S. equity futures can signal whether crypto momentum may follow.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author’s own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.

Earn more PRC tokens by sharing this post. Copy and paste the URL below and share to friends, when they click and visit Parrot Coin website you earn: https://parrotcoin.net0

PRC Comment Policy

Your comments MUST BE constructive with vivid and clear suggestion relating to the post.

Your comments MUST NOT be less than 5 words.

Do NOT in any way copy/duplicate or transmit another members comment and paste to earn. Members who indulge themselves copying and duplicating comments, their earnings would be wiped out totally as a warning and Account deactivated if the user continue the act.

Parrot Coin does not pay for exclamatory comments Such as hahaha, nice one, wow, congrats, lmao, lol, etc are strictly forbidden and disallowed. Kindly adhere to this rule.

Constructive REPLY to comments is allowed