- Bitcoin retests the Bull Market Support Band between $109,600 and $111,900.

- Weekly chart shows repeated support holds since March 2025.

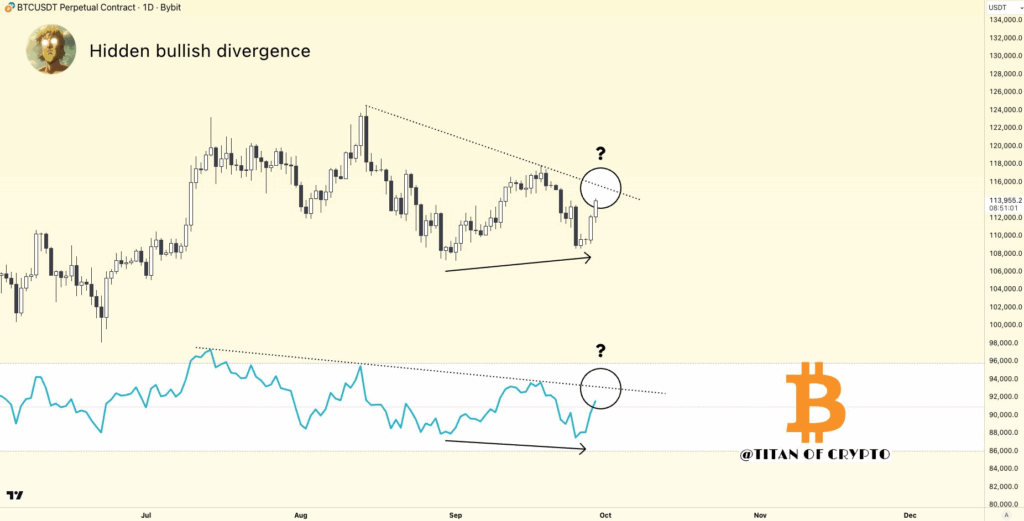

- RSI forms hidden bullish divergence as price nears descending resistance.

Bitcoin’s price action remains centered around a critical weekly support area known as the Bull Market Support Band. This band, made up of closely followed moving averages, has consistently marked significant points during the current uptrend. The weekly chart shows Bitcoin retesting this zone near the $112,000 level after reaching highs earlier in the year.

Price Retests Support Near $112K Level

As of the most recent weekly candle, Bitcoin reached a high of $112,458 before pulling back to $112,036. Daan Crypto reveals that the Bull Market Support Band now ranges between $109,600 and $111,900. Price action continues to respect this range, with candles remaining above the lower boundary.

Earlier in 2025, Bitcoin dipped into this band before regaining upward momentum. The structure shows repeated interactions with the support zone. These moments occurred without breaking below, maintaining the broader trend. Throughout the visible timeframe, Bitcoin has formed higher highs and higher lows. The price stayed above support during each retest since March. The current setup continues to track within this established pattern, holding the band across multiple weekly closes.

Bitcoin Faces Key Resistance as RSI Signals Divergence

In another market observation, Titan of Crypto reveals that Bitcoin is trading near an important resistance level after recovering from recent declines. The BTCUSDT daily chart shows the price climbing upward, approaching a descending trendline that has been in place since mid-July. This line has consistently acted as resistance, marking lower highs across recent sessions.

Alongside price activity, the Relative Strength Index (RSI) reveals a different trajectory. While Bitcoin recorded lower lows in September, RSI instead created higher lows. This setup forms what is identified as a hidden bullish divergence. Currently, RSI is rising toward its own downward-sloping resistance line, mirroring the price pattern above. The chart highlights both price and RSI resistance zones as potential areas for the next test.

Bitcoin’s latest rebound places it near $112,000, still beneath the overhead trendline. RSI has continued upward momentum from its recent bottom, moving steadily toward the upper boundary of its range. The alignment between RSI divergence and price action underlines the significance of the approaching levels. Both indicators are advancing toward descending barriers, setting the stage for a test. Market focus now rests on whether price and RSI meet resistance simultaneously.

Earn more PRC tokens by sharing this post. Copy and paste the URL below and share to friends, when they click and visit Parrot Coin website you earn: https://parrotcoin.net0

PRC Comment Policy

Your comments MUST BE constructive with vivid and clear suggestion relating to the post.

Your comments MUST NOT be less than 5 words.

Do NOT in any way copy/duplicate or transmit another members comment and paste to earn. Members who indulge themselves copying and duplicating comments, their earnings would be wiped out totally as a warning and Account deactivated if the user continue the act.

Parrot Coin does not pay for exclamatory comments Such as hahaha, nice one, wow, congrats, lmao, lol, etc are strictly forbidden and disallowed. Kindly adhere to this rule.

Constructive REPLY to comments is allowed