We’re currently watching China give America what it kinda deserves a little, as the last week of January 2025 turns into a financial bloodbath, with cryptos and US tech stocks collapsing under the weight of Chinese startup DeepSeek’s sudden and unexpected rise.

The AI company announced the development of an artificial intelligence model that is not only faster and cheaper than its competitors but also outperforms them in way too many benchmarks. This has seriously spooked global markets, triggering massive sell-offs from Wall Street to on-chain.

DeepSeek’s AI causes global sell-off

Bitcoin fell by over 5% on Monday to $98,000, according to data from CoinGecko, briefly hitting a low of $97,750 before recovering slightly to $99,080 as of press time.

This crash follows $250 million in Bitcoin long liquidations over the past 24 hours, Coinglass data shows. Leveraged traders who had bet on Bitcoin’s continued rise were forced to sell their assets to cover mounting losses.

Meanwhile, the Nasdaq sank more than 3%, with major tech companies taking a beating. Shares of Coinbase and MicroStrategy fell 6% and 4% respectively.

Bitcoin miners heavily involved in AI-related ventures suffered even worse losses: Core Scientific plunged 28%, Terawulf dropped 25%, and Iren, formerly Iris Energy, nosedived 22%. But if we’re being completely honest, this Chinese vendetta has been a long time coming.

Now, according to DeepSeek, training its AI model costs only $5.8 million. Even if development costs are adjusted to $2 billion—a figure some analysts suggest—it still pales in comparison to the $6.6 billion OpenAI raised in its latest funding round.

DeepSeek’s workforce, at just 200 employees, is minuscule compared to OpenAI’s 4,500-strong team. The AI model’s success has also triggered debate over how the company managed to achieve such groundbreaking results while relying on less advanced chips.

Adding to the chaos, DeepSeek-related memecoins have surged by over 20,000% just today. It’s a bizarre twist in a market that’s watching billions vanish in stock value while meme assets soar.

Peter Schiff weighed in, saying, “China may have jumped ahead of us in AI with DeepSeek, but they can’t touch us when it comes to meme coins. We’ve got that market cornered.” No idea what he even meant by that, knowing him.

Last week, Bitcoin hit a record high of $109,600 in anticipation of President Donald Trump’s executive order on crypto, which was released Thursday. But unfortunately, the order left many traders underwhelmed.

It proposed a national Bitcoin stockpile rather than a reserve, which would have involved actively buying Bitcoin on a regular basis. Traders who had banked on a more aggressive approach were disappointed, especially after the president and his wife, Mrs Melania Trump, rug-pulled investors with their meme coins.

What to know about DeepSeek right now

According to Jefferies analysts, DeepSeek’s AI models are so efficient that their training costs were less than 10% of what Meta spent on its Llama model. The models also outperformed OpenAI’s o1 in benchmarks like AIME and GPQA, achieving superior accuracy in under 8,500 steps.

DeepSeek has also climbed to the top of app store charts in both the US and China, dethroning OpenAI’s ChatGPT as the most downloaded free app. Search interest for DeepSeek has tripled, overtaking both ChatGPT and Gemini. As of January 10th, the app didn’t even rank in the top 100.

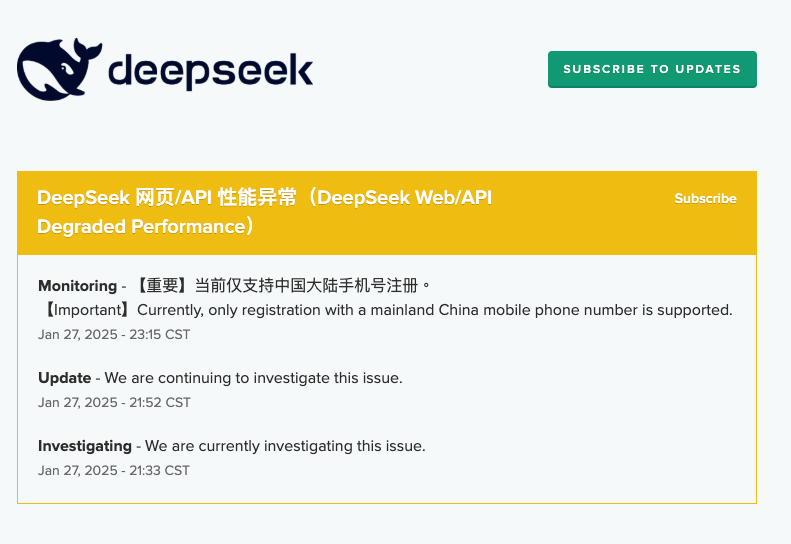

Earlier today, the company announced it was temporarily limiting new user registrations due to what it described as “large-scale malicious attacks” on its services.

Elon Musk, the richest man on earth, speculated that DeepSeek likely has access to roughly 50,000 Nvidia H100 chips, despite U.S. export restrictions on advanced GPUs to China. He also added that: “It obviously wasn’t all done on a $6 million budget.”

There’s actually a lot of doubt about DeepSeek’s claimed costs and raising suspicions about how they’ve bypassed restrictions.

And this whole thing has also had investors second-guessing their bets on chip stocks and questioning the sky-high prices they’ve been paying. This morning, the iShares Semiconductor ETF (SOXX) tumbled over 6%, with Nvidia, Marvell Technology, and U.K.-based Arm Holdings suffering even steeper losses.

Shockingly, Nvidia has actually lost over $600 billion in market capitalization today, making it the largest one-day loss for a single stock in the history of the world.

Deutsche Bank strategist Jim Reid called out the “stratospheric” valuations in a note to clients, pointing out that some chipmakers are priced even higher than big-name tech companies like Apple and Meta.

Nvidia, for instance, started the week trading at roughly 56 times its trailing 12-month earnings, while Advanced Micro Devices (AMD) has a price-to-earnings ratio in the triple digits. Marvell Technology, despite losing money, boasts a market cap of over $100 billion.

Cryptopolitan Academy: Are You Making These Web3 Resume Mistakes? – Find Out Here

Earn more PRC tokens by sharing this post. Copy and paste the URL below and share to friends, when they click and visit Parrot Coin website you earn: https://parrotcoin.net0

PRC Comment Policy

Your comments MUST BE constructive with vivid and clear suggestion relating to the post.

Your comments MUST NOT be less than 5 words.

Do NOT in any way copy/duplicate or transmit another members comment and paste to earn. Members who indulge themselves copying and duplicating comments, their earnings would be wiped out totally as a warning and Account deactivated if the user continue the act.

Parrot Coin does not pay for exclamatory comments Such as hahaha, nice one, wow, congrats, lmao, lol, etc are strictly forbidden and disallowed. Kindly adhere to this rule.

Constructive REPLY to comments is allowed