The DASH price has entered a decisive technical phase after cooling off from a strong impulsive rally earlier this month. While recent price action reflected a period of consolidation, but the improving underlying structure and on-chain data suggest that the market may be preparing for its next directional move, which is raising market curiosity while keeping traders focused on current support whether DASH/USD can sustain momentum.

DASH Price Chart Shows Controlled Pullback After January Rally

On the technical front, the DASH price chart reveals that the asset recently surged aggressively in January, setting a local high near $96.5 before entering a measured retracement.

Importantly, this decline unfolded in a corrective manner rather than an impulsive sell-off, indicating profit-taking instead of broad distribution. As a result, downside pressure appears limited, with price now seems to be stabilizing above key levels.

From a technical standpoint, the current consolidation phase has allowed the market to absorb supply while preserving the broader bullish structure.

At present, DASH price today is holding firmly above the $62.4 support level at $70.29, when writing.

The improving intraday DASH price 12% upside reaction and a gradual pickup in volume show bullish demand rising.

Moreover, price has respected the lower boundary of a developing symmetrical triangle pattern around $40 in early January, suggesting that sellers are losing momentum while demand begins to rebuild. Also, this pattern’s reduced trading range shows a coiling range that will result in a strong upside move.

DASH Price Prediction Hinges on Volume and Pattern Resolution

For the bullish scenario to remain valid, volume expansion will be critical. A sustained increase in participation could allow the DASH price USD pair to retest the January highs near $96.5. If that level is revisited with strength, a breakout from the upper boundary of the triangle becomes increasingly plausible.

In that scenario, the DASH price forecast opens toward the $134–$140 region. From current levels near $70, such a move would represent a significant 100% upside extension, contingent on market follow-through.

On-Chain Data Signals Growing Institutional Interest in DASH Crypto

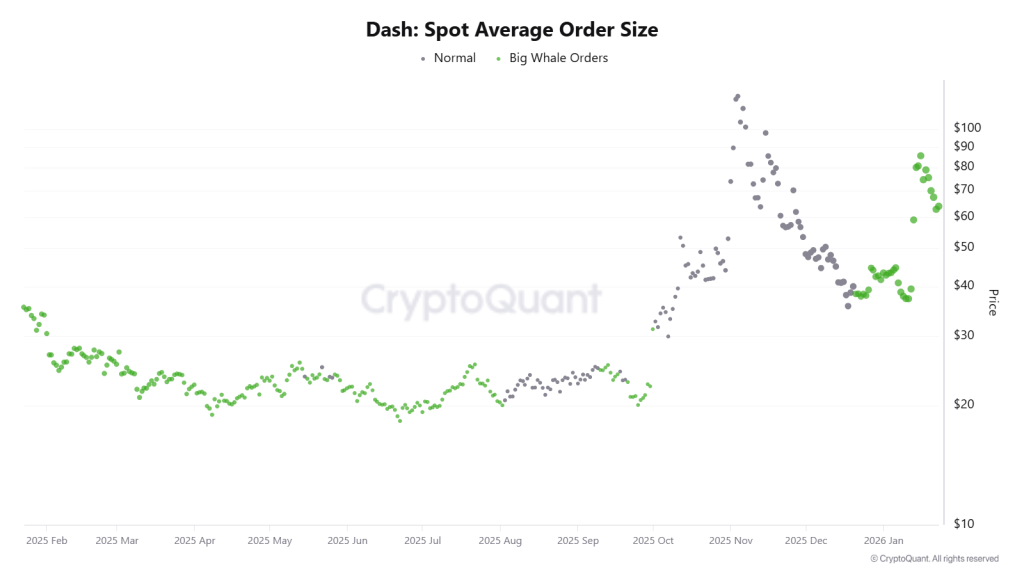

Supporting the technical setup, CryptoQuant data shows a noticeable rise in average spot order sizes. Larger transactions typically reflect increased activity from high-net-worth participants, suggesting that whale interest in DASH crypto has been building during the consolidation phase.

This accumulation-style behavior often precedes directional expansion, especially when combined with stable price structure and improving liquidity conditions.

Adoption News Adds Fundamental Support to DASH Price

Adding to the constructive outlook, DASH price received a boost following an official update announcing Dash’s partnership with AEON. The integration enables DASH payments across more than 50 million offline merchants in Southeast Asia, Africa, and Latin America via AEON Pay QR codes.

Additionally, Dash representatives confirmed ongoing integrations with major payment platforms and plans to embed AEON functionality into the native DashPay wallet. These developments expand real-world usability and may help reinforce long-term demand dynamics.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author’s own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.

Earn more PRC tokens by sharing this post. Copy and paste the URL below and share to friends, when they click and visit Parrot Coin website you earn: https://parrotcoin.net0

PRC Comment Policy

Your comments MUST BE constructive with vivid and clear suggestion relating to the post.

Your comments MUST NOT be less than 5 words.

Do NOT in any way copy/duplicate or transmit another members comment and paste to earn. Members who indulge themselves copying and duplicating comments, their earnings would be wiped out totally as a warning and Account deactivated if the user continue the act.

Parrot Coin does not pay for exclamatory comments Such as hahaha, nice one, wow, congrats, lmao, lol, etc are strictly forbidden and disallowed. Kindly adhere to this rule.

Constructive REPLY to comments is allowed