Ether got wrecked. The second-biggest crypto by market cap plunged 26.53% on Monday in Asia, falling to $2,135, according to Bloomberg data. It was Ether’s steepest fall in nearly four years, beating its May 2021 disaster.

Bitcoin took a 8% dip to $92,000, dragging every major token down with it. Solana (SOL) lost 13% and is trading at $184, and XRP crashed by 28% in Asia, plunging to $1.82, way below its $3 high from just a month ago, according to data from CoinGecko.

Trump’s infamous memecoin (TRUMP), which had seen some early hype post-election, crashed 12%, proving once again that meme coins are as fragile as they sound. The CoinDesk 20 (CD20), which tracks for top 20 crypto assets, slumped nearly 21%.

Data from Coinglass confirmed just how bloody the day was. Within 12 hours, traders watched $1.3 billion in long positions get liquidated. Ether holders suffered the worst, with $400 million gone in an instant. Bitcoin wasn’t far behind, with $300 million in long BTC positions obliterated.

This whole panic was triggered by self-proclaimed ‘crypto president’ Donald Trump’s announcement over the weekend that the US would impose 25% tariffs on imports from Canada and Mexico. Traders (sensitive as ever) saw the decision as a sign of global economic instability, and so markets reacted fast.

An op-ed from The Wall Street Journal didn’t hold back, calling the tariff escalation “the Dumbest Trade War in History.” But Trump fired back on Truth Social, doubling down on his stance. “Anybody that’s against tariffs, including the Fake News Wall Street Journal and Hedge Funds, is only against them because these people or entities are controlled by China,” he wrote.

He claimed the tariffs were necessary and hinted that they should’ve never been replaced by the income tax system back in 1913. “The response to tariffs has been FANTASTIC!” he added.

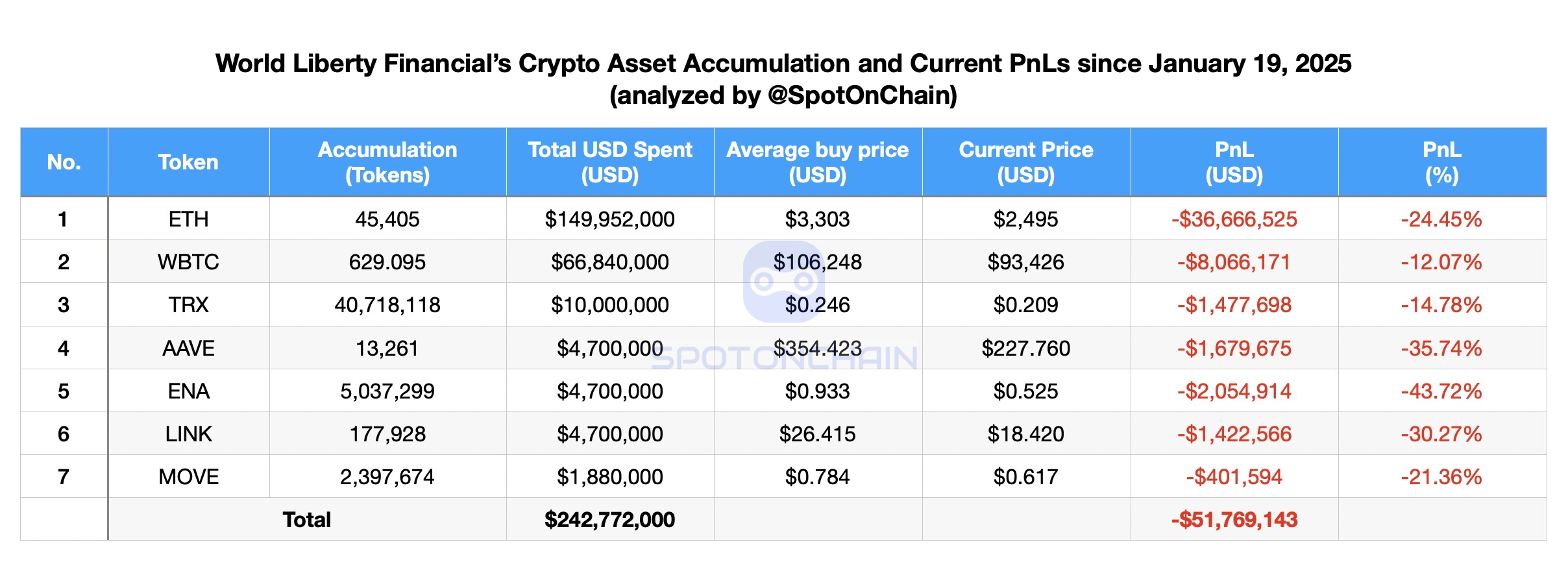

But interestingly enough, according to Spot on Chain, the Trump family crypto project World Liberty has lost $51.7 million or about 21%, from its $242.77 million crypto investment since the tariff announcement. Among them of course is Ether, which lost $36.7 million (-24.4%), WBTC which tumbled by 12.1% losing $8 million, and ENA which lost $2.05 million (-43.7%).

Meanwhile, according to Parsec, in the past twenty-four hours, the lending liquidation volume on the DeFi chain exceeded $310 million, the highest point since early August 2024, of which ETH collateral liquidation volume reached $181 million, followed by wBTC at $49.2 million.

Dogecoin, backed by Elon Musk, lost 14% on Monday, continuing its free fall to 45% below the high it hit after Trump’s election win in December.

Cardano (ADA), Avalanche (AVAX), and Chainlink (LINK) all posted double-digit losses, each dropping more than 10%.

Cryptopolitan Academy: FREE Web3 Resume Cheat Sheet – Download Now

Earn more PRC tokens by sharing this post. Copy and paste the URL below and share to friends, when they click and visit Parrot Coin website you earn: https://parrotcoin.net0

PRC Comment Policy

Your comments MUST BE constructive with vivid and clear suggestion relating to the post.

Your comments MUST NOT be less than 5 words.

Do NOT in any way copy/duplicate or transmit another members comment and paste to earn. Members who indulge themselves copying and duplicating comments, their earnings would be wiped out totally as a warning and Account deactivated if the user continue the act.

Parrot Coin does not pay for exclamatory comments Such as hahaha, nice one, wow, congrats, lmao, lol, etc are strictly forbidden and disallowed. Kindly adhere to this rule.

Constructive REPLY to comments is allowed