As Ethereum’s presence in smart contracts nears the 40% threshold, the scarcity of this cryptocurrency is becoming more evident. However, recent market trends paint a complex picture for ETH enthusiasts.

Ethereum’s Growing Scarcity

The increasing allocation of Ethereum into smart contracts signifies a tightening supply. With nearly 40% of ETH now locked in these contracts, the available amount for trading and other uses diminishes. This scarcity could potentially lead to significant price movements if demand surges, making ETH a crypto asset to watch closely. In the last 24 hours, the price of Ethereum has marked a rise of around 4.8%, and in the last 7-days, the price has recorded an increase of over 5.5%.

Ethereum Market Indicators Show Mixed Signals

Despite the promising scarcity narrative, several market indicators suggest challenges ahead for Ethereum:

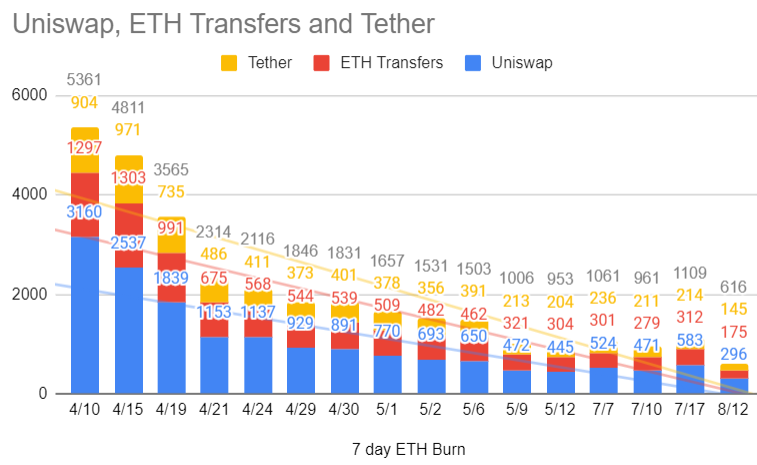

Burn Rate Decline: The burn rate, which is a measure of ETH being removed from circulation, has hit an all-time low. This decline contributes to higher net issuance. This raises concerns about inflationary pressures on Ethereum.

Layer 2 Adoption Concerns: The transition to Layer 2 solutions, aimed at improving scalability and efficiency, has not spurred the anticipated usage levels. This slow adoption raises questions about Ethereum’s ability to handle growing demand.

Stablecoin Dominance: Ethereum’s primary utility appears to be shifting towards facilitating stablecoin transactions. This reliance on stablecoin movement may not be sustainable for long-term growth.

Declining Uniswap Volume: Uniswap, which is one of the major decentralized exchanges on the Ethereum network, is experiencing dwindling volumes. Current activity hovers just above 10% of what was observed in March. What this indicates is reduced trading enthusiasm.

Ethereum Price Movements Reflect Volatility

The current price of Ethereum is $2,648.2, marking a decline from $3,188.5 at the beginning of August 2024. This drop is part of a broader trend, with a significant decrease observed between July 29th and August 7th, when the price fell from $3,314.4 to $2,333.3. Earlier in the year, ETH began at around $2,349.5, experiencing a sharp rise between January 25th and March 11th, peaking at $4,069.5. The price then entered a sideways market, stabilising between $3,669.4 and $3,888.8 from May 20th to June 10th.

Etheruem’s journey in 2024 showcases a blend of scarcity-induced potential and market-induced challenges. As the crypto community watches closely, the balance between these dynamics will shape Etheruem’s trajectory in the coming months.

Also Check Out: Markets Could Remain Highly Volatile: Here are the Cryptos to Monitor This Week

Earn more PRC tokens by sharing this post. Copy and paste the URL below and share to friends, when they click and visit Parrot Coin website you earn: https://parrotcoin.net0

PRC Comment Policy

Your comments MUST BE constructive with vivid and clear suggestion relating to the post.

Your comments MUST NOT be less than 5 words.

Do NOT in any way copy/duplicate or transmit another members comment and paste to earn. Members who indulge themselves copying and duplicating comments, their earnings would be wiped out totally as a warning and Account deactivated if the user continue the act.

Parrot Coin does not pay for exclamatory comments Such as hahaha, nice one, wow, congrats, lmao, lol, etc are strictly forbidden and disallowed. Kindly adhere to this rule.

Constructive REPLY to comments is allowed