Benjamin Cowen, the founder of Into The Cryptoverse, thinks Ethereum’s upcoming spot ETFs won’t spark a rally. Instead, they’re likely to cause a dip. Why? Because of Ethereum’s supply issues.

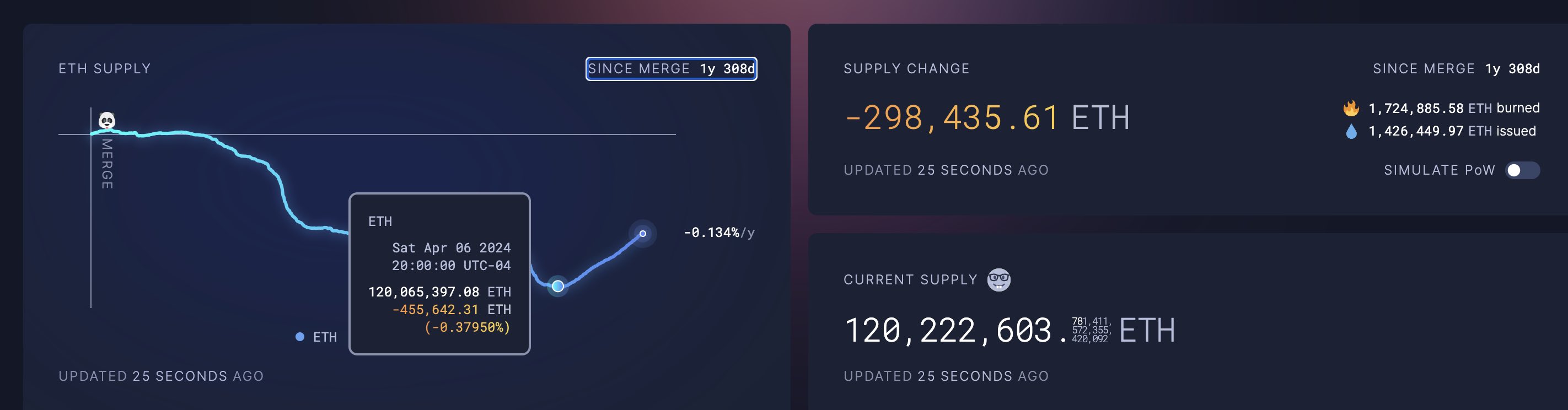

Since April, the supply of Ethereum has been increasing by about 60,000 ETH each month. If this continues, by December, the supply will be back to what it was during the Merge in September 2022. In Benjamin’s words:

“If the supply of ETH keeps increasing by ~60k/month like it has been since April, then by Dec the supply will be back to what it was at the merge.”

Over the last 30 days, the supply of ETH has gone up by nearly 60,000 ETH. In April 2024, the supply had decreased by about 455,000 ETH since the Merge. But in just three months, it has increased by around 150,000 ETH.

Currently, the supply is down by 298,000 ETH since the Merge. But at this rate, it will revert soon. Benjamin pointed out that people might focus on this narrative later this year instead of monetary policy. He said:

“Could be a narrative that people focus on later this year, when they should actually focus on monetary policy.”

In 2016, there was a fakeout below the lows in Q2, followed by a real capitulation in Q4 during the Bitcoin halving year. Benjamin suggests that we might see a similar pattern this year.

If Ethereum follows the 2016 pattern, the final capitulation might not start until September 2024. This timeline could coincide with the novelty of the spot ETF wearing off.

Another critical point is the Federal Reserve’s monetary policy. During the last cycle, ETH/BTC broke support the same month the Fed cut rates. This September, the Fed is likely to cut rates again, just like in 2016.

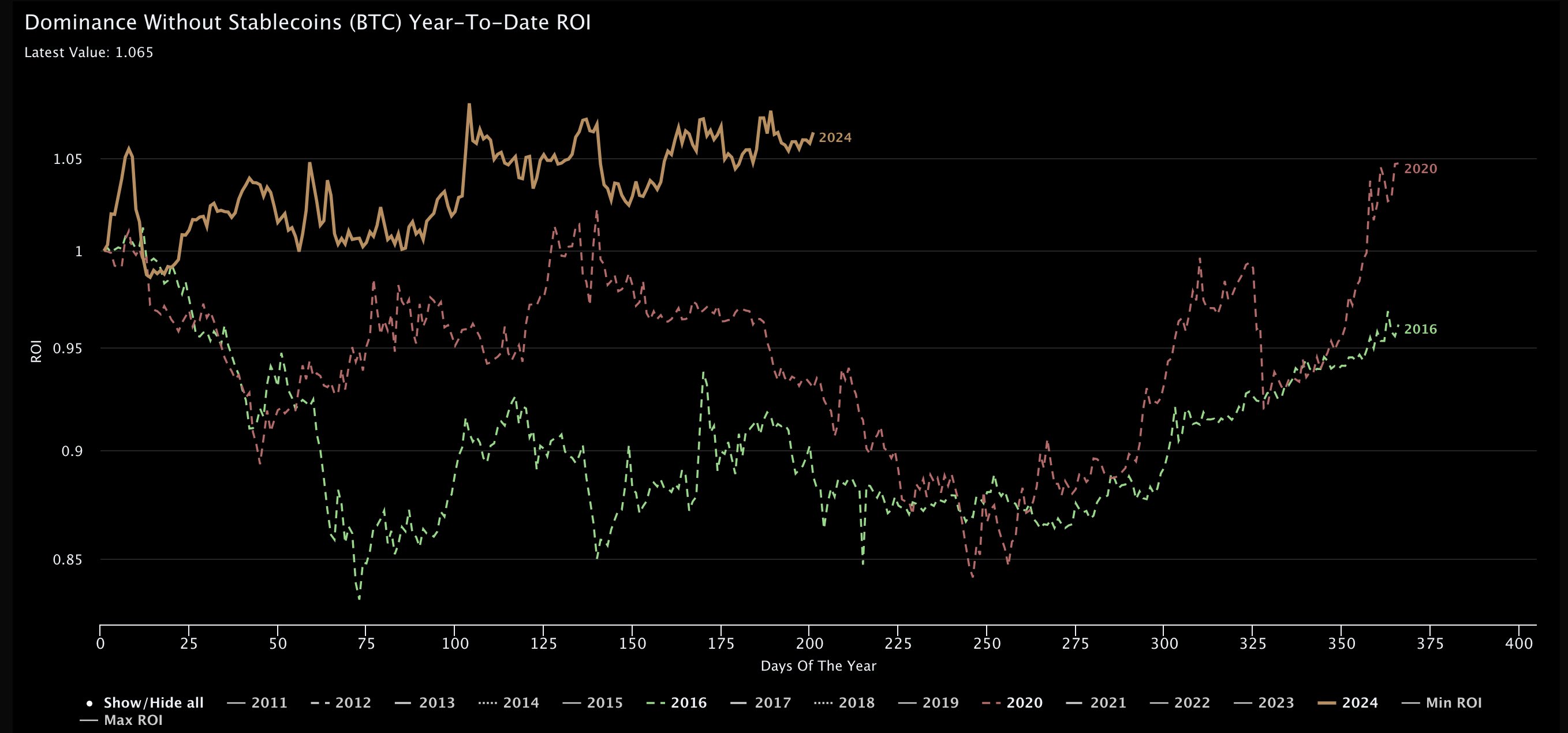

Usually, Bitcoin dominance stalls in Q3 of halving years before a major rally in Q4. But this year, Bitcoin’s dominance has been stronger than in previous halving years. Benjamin also noticed that:

“2024 ETH/BTC is following the 2019/2020 average.”

According to the 2019/2020 average, the final low for ETH/BTC was not set until Q4. In 2016, ETH/BTC hit lows in August, rallied in September, then reversed course through the end of the year.

If ETH/USD follows the same pattern, we could see a short-lived rebound before a dip in Q4, followed by a surge next year. When the spot Bitcoin ETF launched, there was an initial surge followed by a sharp decline.

If Ethereum’s spot ETFs follow a similar trajectory, there might be an initial dip, a rebound, and then another drop before a big surge up next year. So far, ETH/USD in 2024 has been closely tracking the 2016 pattern.

And if this continues, we might see a lower low for ETH/BTC later this year. Benjamin suggested that if ETH/BTC holds the May 2024 low by the end of the year, it could signal that the low is in.

However, he also warned of a decent chance that ETH/BTC will be lower than it is today in the next three to six months. He ended his analysis with:- “I think ETH/BTC will go up in 2025. Also, I get things wrong all the time so please hedge these views.”

Earn more PRC tokens by sharing this post. Copy and paste the URL below and share to friends, when they click and visit Parrot Coin website you earn: https://parrotcoin.net0

PRC Comment Policy

Your comments MUST BE constructive with vivid and clear suggestion relating to the post.

Your comments MUST NOT be less than 5 words.

Do NOT in any way copy/duplicate or transmit another members comment and paste to earn. Members who indulge themselves copying and duplicating comments, their earnings would be wiped out totally as a warning and Account deactivated if the user continue the act.

Parrot Coin does not pay for exclamatory comments Such as hahaha, nice one, wow, congrats, lmao, lol, etc are strictly forbidden and disallowed. Kindly adhere to this rule.

Constructive REPLY to comments is allowed