Fundstrat Head of Research Tom Lee has emphasized that Bitcoin’s recent surge could mark the beginning of a sustained rally. With Bitcoin’s price climbing 34% in November and currently trading near $91,395, Tom Lee outlined several factors suggesting the cryptocurrency’s upward momentum may persist.

Tom Lee Highlights Why Bitcoin Price Rally May Continue

Speaking in an interview with CNBC, Fundstrat Head of Research Tom Lee noted that Bitcoin’s recent price gains are supported by strong market demand and improving technical indicators.

He pointed out that Bitcoin price has entered a consolidation phase near $90,000, which is supported by a series of bullish factors, including increased investor interest and the cryptocurrency’s historical performance during similar market conditions.

According to Fundstrat’s Tom Lee, the current price rally aligns with broader trends in risk assets, with Bitcoin showing resilience amid market corrections. He stated, “Most major indices, including the NASDAQ and S&P 500, have pulled back to key support levels, which often provides a foundation for renewed growth. Bitcoin’s technical setup appears similar, suggesting the possibility of further gains.”

Fundstrat’s Tom Lee also connected Bitcoin’s performance to broader market trends, particularly the “Trump trade.” He remarked that policies like ‘D.O.G.E’ emphasizing deregulation, lower taxes, and reduced government spending could benefit risk assets, including Bitcoin price.

He added that sectors like small-cap stocks and financials are also seeing renewed interest as investors anticipate policy clarity following recent political developments. This optimism is bolstered by expectations that the Federal Reserve’s monetary tightening cycle is nearing its end, which could drive demand for both traditional and digital assets.

Bitcoin as a Strategic Asset Amid Economic Concerns

Fundstrat’s Tom Lee also highlighted Bitcoin’s potential role as a strategic asset in addressing economic challenges. While he did not directly revisit his earlier suggestion that Bitcoin could serve as a “treasury reserve asset,” Lee emphasized its appeal as a hedge against macroeconomic uncertainty.

He explained that ongoing discussions about U.S. monetary policy, including the Federal Reserve’s potential slowdown in interest rate hikes, are contributing to a favorable environment for Bitcoin.

“When uncertainty clears around monetary policy, demand for Bitcoin and other risk assets could increase further,” he noted.

During the interview, Tom Lee addressed the ongoing discussions surrounding the U.S. Treasury Secretary position under the Biden administration. Among the names under consideration hinted at by Elon Musk is Cantor Fitzgerald CEO Howard Lutnick, an advocated for Bitcoin’s recognition as a commodity akin to gold and oil.

Institutional and Retail Momentum Behind Bitcoin’s Growth

Institutional and retail participation has played a key role in Bitcoin price recent surge. Data from CryptoQuant indicates a spike in Coinbase’s premium index earlier in the rally, signaling heightened interest from U.S. retail investors. However, the index has since cooled, suggesting that retail activity has slowed in the short term.

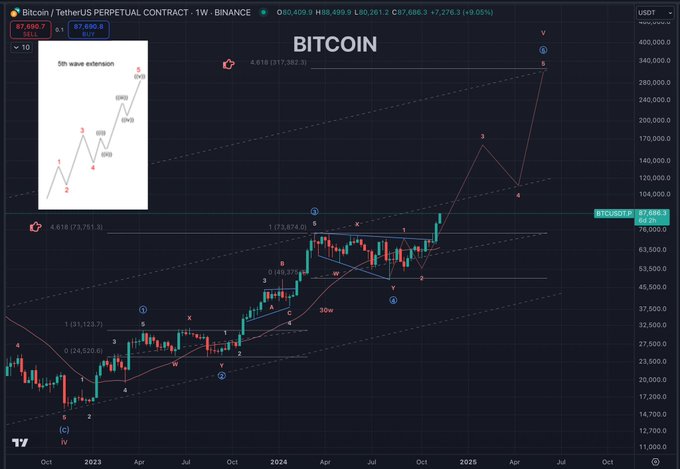

Technical analyst Coosh Alemzadeh has observed patterns in Bitcoin’s chart that indicate the potential for further growth. According to Alemzadeh, Bitcoin is currently in the fifth wave of an Elliott Wave cycle, which typically signals the steepest part of a price rally. His projection suggests Bitcoin’s price could reach between $130,000 and $145,000 by late 2024.

Despite the optimistic outlook, experts caution that Bitcoin’s volatility remains high. The success rate for bullish patterns like the one currently forming is only around 54%, highlighting the need for measured optimism among traders.

The post Fundstrat’s Tom Lee Highlights Why Bitcoin Price Rally May Continue appeared first on CoinGape.

Earn more PRC tokens by sharing this post. Copy and paste the URL below and share to friends, when they click and visit Parrot Coin website you earn: https://parrotcoin.net0

PRC Comment Policy

Your comments MUST BE constructive with vivid and clear suggestion relating to the post.

Your comments MUST NOT be less than 5 words.

Do NOT in any way copy/duplicate or transmit another members comment and paste to earn. Members who indulge themselves copying and duplicating comments, their earnings would be wiped out totally as a warning and Account deactivated if the user continue the act.

Parrot Coin does not pay for exclamatory comments Such as hahaha, nice one, wow, congrats, lmao, lol, etc are strictly forbidden and disallowed. Kindly adhere to this rule.

Constructive REPLY to comments is allowed