Not just crypto but the Global Stock markets are plunging. Robinhood created waves in bearish crypto waters by hauling their 24 hour trading. This splits the community into two types of believers. There are some who are appreciating this move and the other who are calling it market manipulation. Let’s explore what exactly happened and what community is feeling.

Robinhood’s Response to Market Chaos

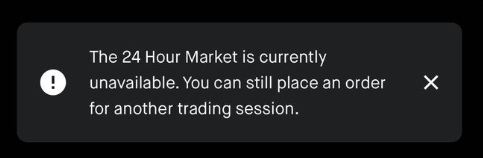

Robinhood has suspended its 24-hour trading service in the wake of the market freefall. Users have taken to social media to report that the trading halt is linked to the Blue Ocean Alternative Trading Systems (BOATS). BOATS is designed to prevent stocks from swinging too wildly by stopping trades if prices move more than 20% up or down during extended hours. While this might protect against extreme volatility, it’s left many users feeling stranded.

Global Markets Take a Nosedive

On Monday, Aug. 5, major indices around the world saw their worst declines in years. In the U.S., the S&P 500 dropped 1.8%, and the Dow Jones Industrial Average slipped 1.51%. Over in Europe, the FTSE 100 fell by 2.3%, marking its biggest single-day drop in over a year. But the hardest hit was in Asia, where Japan’s Nikkei 225 plummeted over 12% – its worst fall since the 1987 Black Monday crash. South Korea’s Kospi also took a hit, closing 8.8% lower.

Crypto Markets Hit Hard

The crypto market didn’t escape the carnage. The total market cap for cryptocurrencies fell by a staggering 15.7% in just 24 hours. Bitcoin dropped over 26%, and Ethereum took a 33% hit. The losses have echoes of past crises like the FTX collapse and the Terra-Luna debacle, leaving traders wary and on edge.

Tech Stocks in Freefall

Tech stocks have been particularly hard hit. Alphabet (GOOGL) fell 6.79% in pre-market trading, Amazon (AMZN) dropped 2.82%, and Microsoft (MSFT) slid 3.5%. Nvidia (NVDA), Apple (AAPL), Meta (META), and Tesla (TSLA) also saw significant losses, with some experiencing drops of up to 10%.

Japanese Market Volatility

Japan’s stock market hasn’t fared any better. The Bank of Japan’s decision to raise interest rates triggered a sell-off, causing the Nikkei 225 and Topix indices to tumble. This marked the worst two-day performance since the 2011 earthquake and tsunami, further shaking investor confidence.

Robinhood’s decision to pause 24 hour trading is a defensive move. It aims to protect retail investors from making panic-driven decisions during this period of extreme volatility. However, the suspension has also sparked concerns about market manipulation and the overall health of the financial system. As the dust settles, investors will be watching closely for any signs of stability.

Earn more PRC tokens by sharing this post. Copy and paste the URL below and share to friends, when they click and visit Parrot Coin website you earn: https://parrotcoin.net0

PRC Comment Policy

Your comments MUST BE constructive with vivid and clear suggestion relating to the post.

Your comments MUST NOT be less than 5 words.

Do NOT in any way copy/duplicate or transmit another members comment and paste to earn. Members who indulge themselves copying and duplicating comments, their earnings would be wiped out totally as a warning and Account deactivated if the user continue the act.

Parrot Coin does not pay for exclamatory comments Such as hahaha, nice one, wow, congrats, lmao, lol, etc are strictly forbidden and disallowed. Kindly adhere to this rule.

Constructive REPLY to comments is allowed