Last week, three Hong Kong issuers, China Asset Management, Bosera Asset Management, and Harvest Global Investments, launched their products in the Hong Kong market. The development reflects the city-state’s interest to participate in the global crypto ETF race. The crypto ETF market is presently dominated by the West, primarily the United States. As the East, especially China, steps into this race, it opens a new arena for direct competition between the US and China. Let’s analyse the performance of these three ETFs to understand how successful they have become so far in turning the wave in favour of the East.

1. China Asset Management ETFs General Analysis

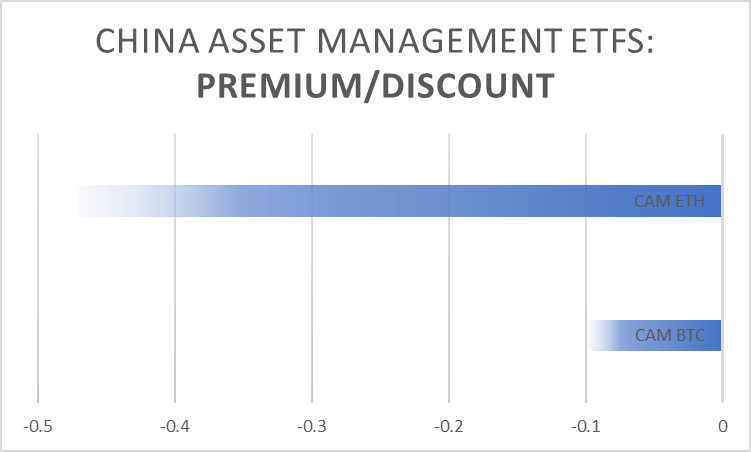

ChinaAMC Bitcoin ETF, and ChinaAMC ETHER ETF are the two products launched on 30th April, 2024 by the issuer China Asset Management (Hong Kong) Limited.

| ETFs | Premium/DiscountOn 3rd, May | Price | Price Change | AUM | Volume | Turnover |

| CAM BTC | -0.10% | HK$8.085 | +8.89% | HK$970.64M | 3.13M | HK$25.14M |

| CAM ETH | -0.47% | HK$7.770 | +6.95% | HK$164.96M | 491.40K | HK$3.78M |

The price of CAM BTC on 30th April, the day of listing, was HK$7.95; that day it had a premium of 0.06%. Though on 1st May, its price slipped to HK$7.25, it had a premium of 0.17%. On 2nd May, its price slightly climbed to HK$7.43, it had a discount of -0.10%. Now, it costs around HK$8.085 and marks a change of +8.89%.

CAM ETH’s price on the day of listing, 30th April, 2024, was HK$7.77. That day, it had a premium of 0.08%. On 1st May, its price decreased to HK$7.18, but it had a premium of 0.14%. On 3rd of May, though it saw a slight increase in price, it had a discount of -0.47%. Now, its price is HK$7.770, and it snows a positive change of +6.95%.

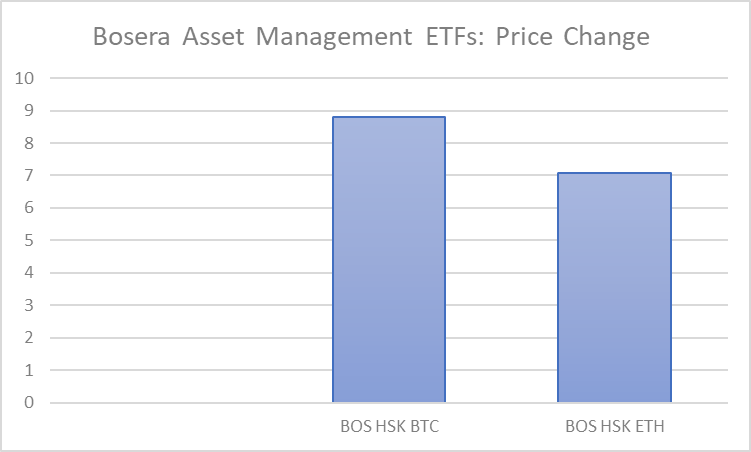

2. Bosera Asset Management ETFs General Analysis

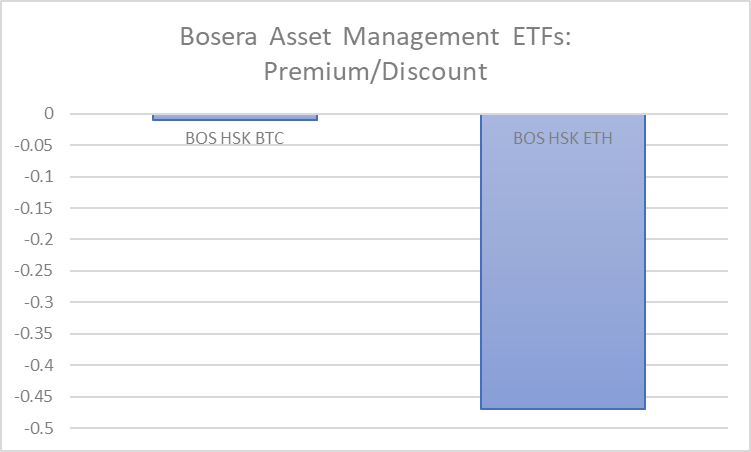

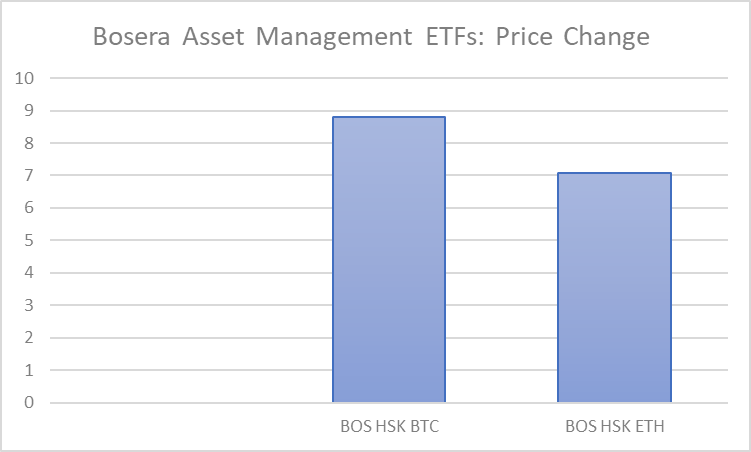

Bosera Hashkey Bitcoin ETF and Bosera Hashkey Ether ETF are the two products launched on 30th April, 2024 by the issuer Bosera Asset Management (International Co., Limited.

| ETFs | Premium/DiscountOn 3rd, May | Price | Price Change | AUM | Volume | Turnover |

| BOS HSK BTC | -0.01% | HK$50.420 | +8.80% | HK$472.71M | 248.75K | HK$12.47M |

| BOS HSK ETH | -0.47% | HK$24.820 | +7.08% | HK$111.78M | 104.62K | HK$2.56M |

On the day of listing, on 30th April 2024, the price of BOS HSK BTC was around HK$49.58, and it had a premium of 0.07%. On 2nd May, the price slipped to HK$45.12, but it had a premium of 0.03%. On 3rd May, even though its price reached HK$46.34, it had a discount of -0.01%. At present, its price is HK$50.420 and it records a positive change of +8.80%.

On the day of listing, on 30th April 2024, the price of BOS HSK ETH was HK$24.80. At that time, it had a premium of 0.13%. On 2nd May, it saw a drop. The price fell to HK$22.90, but it had a premium of 0.18%. On 3rd May, it had a discount of -0.47%, though its price slightly improved and touched HK$23.18. At this moment, its price is HK$24.820, and it registers a positive change of +7.08%.

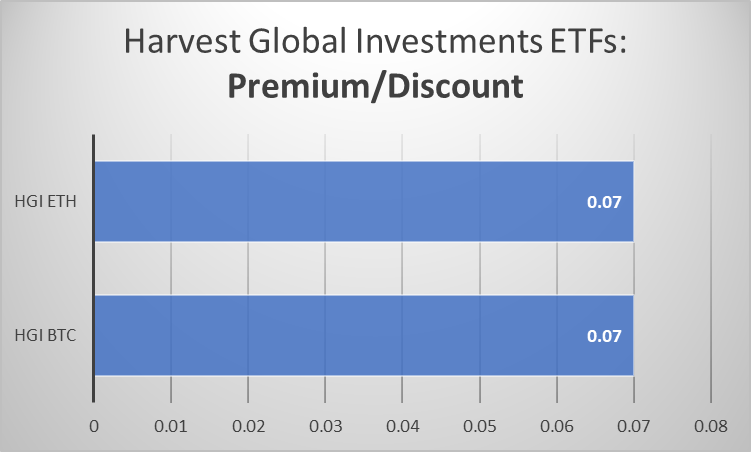

3. Harvest Global Investments ETFs General Analysis

Harvest Bitcoin Spot ETF and Harvest Ether Spot ETF are the two products launched on 30th April 2024 by the issuer Harvest Global Investments Limited.

| ETFs | Premium/DiscountOn 2nd, May | Price | Price Change | AUM | Volume | Turnover |

| HGI BTC | +0.07% | HK$8.095 | +8.73% | HK$513.30M | 1.66M | HK$13.33M |

| HGI ETH | +0.07% | HK$7.790 | +6.86% | HK$102.48M | 405.70K | HK$3.13M |

On the day of listing, the price of HGI BTC was HK$7.95. Notably, unlike most ETFs launched that day, on the listing day, it had a discount of -0.13%. On 2nd May 2024, its price was slightly reduced to HK$7.27, but it had a premium of 0.07%. At present, its price is HK$8.095, far higher than its listing price. It records a positive change of +8.73%.

The listing price of HGI ETH was HK$7.77. Similar to HGI BTC, on the listing day, HGI ETH had a discount of -0.26%. On the 2nd of May 2024, its price reached as low as HK$7.20. Notably, on that day, it had a premium of +0.07%. At this juncture, its price is HK$7.790, slightly better than its listing price. It showcases a positive change of +6.86%.

Endnote

The debut of spot Bitcoin and Ethereum ETFs in Hong Kong signifies a strategic expansion of the Crypto ETF market beyond Western boundaries. The varied performance of ETFs from China Asset Management, Bosera Asset Management, and Harvest Global Investments during the first week reflects a dynamic and evolving landscape. With price fluctuations, premiums, and discounts noted, these ETFs offer insights into investor sentiment and market trends in the East. As Hong Kong strengthens its position in the global crypto ecosystem, its success could pave the way for broader acceptance and innovation in cryptocurrency investment, potentially challenging the dominance of Western markets.

Earn more PRC tokens by sharing this post. Copy and paste the URL below and share to friends, when they click and visit Parrot Coin website you earn: https://parrotcoin.net0

PRC Comment Policy

Your comments MUST BE constructive with vivid and clear suggestion relating to the post.

Your comments MUST NOT be less than 5 words.

Do NOT in any way copy/duplicate or transmit another members comment and paste to earn. Members who indulge themselves copying and duplicating comments, their earnings would be wiped out totally as a warning and Account deactivated if the user continue the act.

Parrot Coin does not pay for exclamatory comments Such as hahaha, nice one, wow, congrats, lmao, lol, etc are strictly forbidden and disallowed. Kindly adhere to this rule.

Constructive REPLY to comments is allowed