The latest 13-F filings, released on August 14, 2024, have revealed intriguing developments in the cryptocurrency market. These reports, filed quarterly by investment managers overseeing at least $100 million in assets, highlight the top holdings in U.S. publicly traded securities, including Exchange-Traded Funds (ETFs). One standout trend from the second quarter of 2024 is the significant increase in institutional ownership of U.S. Spot Bitcoin ETFs compared to the previous quarter.

This spike in institutional interest suggests a growing confidence in Bitcoin. By analyzing the data from Q2 2024, we can uncover key developments in the Bitcoin Spot ETF sector. This exploration will provide insights into what this trend could mean for the broader market. Let’s begin!

Bitcoin Spot ETF Market Overview

The total market for Bitcoin Spot ETFs stands at $76.47 billion, with Grayscale leading the pack at a market cap of $32.98 billion, closely followed by BlackRock at $23.58 billion.

Here’s a breakdown of the top Bitcoin Spot ETFs by market cap:

| Issuer | Ticker | Price | AUM | Market Cap |

| Grayscale | GBTC | $47.63 | $24.33B | $32.98B |

| BlackRock | IBIT | $34.03 | $17.24B | $23.58B |

| Fidelity | FBTC | $52.24 | $9.90B | $12.04B |

| Ark/21 Shares | ARKB | $59.70 | $2.85B | $3.38B |

| Bitwise | BITB | $32.53 | $2.16B | $2.59B |

| VanEck | HODL | $67.56 | $529.70M | $749.18M |

| Valkyrie | BRRR | $16.91 | $501.80M | $609.99M |

| Franklin Templeton | EZBC | $34.64 | $312.00M | $456.69M |

| WisdomTree | BTCW | $63.38 | $79.70M | $87.81M |

Apart from Grayscale and BlackRock, other prominent Bitcoin Spot ETFs are Fidelity, Ark/21 Shares, Bitwise, VanEck, Valkyrie, Franklin Templeton and WisdomTree.

Fidelity displays a market cap of $12.04B. Ark/21 Shares and Bitwise follow with $3.38B and $2.59B respectively. The market cap values of other ETFs range between $749.18M and $87.81M. Among the ETFs that fall inside the range, VanEck is the topmost one, and WisdomTree is the weakest.

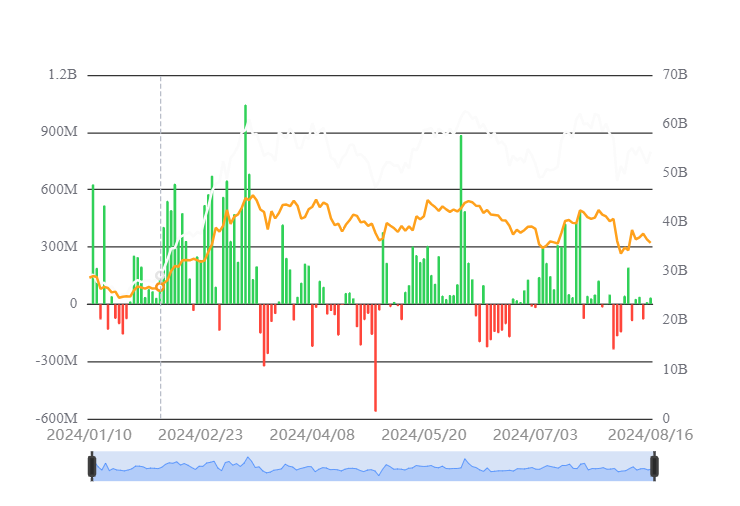

Bitcoin ETF Net Inflows & Market Dynamics

As of today, the total daily net inflow of Bitcoin Spot ETFs is $36.01M. And, the total net assets value is $54.35B.

In late January 2024, the net assets value was just $25.28B. At the time the price of Bitcoin was nearly $39,880.60. As the price of BTC started to climb, the value of total net assets also followed the trend naturally. The value reached a peak of $60.96B on 13th March. At that time, the BTC price also made a milestone crossing $73,000. Since then, the value of total net assets has remained in a range between $47.08B and $63B.

This year, we have witnessed several periods of consistent outflow: between 22nd Jan and 25th Jan, 18th March and 22nd March, 12th April and 18th April, 24th April and 2nd May, 13th June and 24th June, and most recently between 2nd August and 6th August.

Among these periods of consistent outflows, the most bitter was the one witnessed between 24th April and 2nd May. During this period, the value of total net assets dropped from $53.65B to $48.48B. On 1st May, the outflow was so intense that it pushed the value down to $47.08B, though it slightly recovered the next day. The daily total net inflow on 1st May was around -563.77M.

During the period of continuous outflow between 13th June and 24th June, the value of total net assets fell from $58.53B to $51.53B.

This year, the net inflow scenario was largely positive in nature. Between 25th January and 15th March, a strong positive sentiment was observed. On 12th March, the daily total net inflow of Bitcoin Spot ETFs was as high as $1.05B. The second-highest daily total net inflow was recorded on 4th June.

This month – August 2024, the Bitcoin Spot ETF market showed poor performance in terms of daily total net inflow. A period of consistent outflow was developed between 2nd August and 6th August. The highest inflow of the month was $192.56M reported on 8th August. The highest outflow of the month was -$237.45M, recorded on the first day of the period of consistent outflow of the month – 2nd August.

Who Holds the Most Bitcoin?

Now, to the big question: which issuer holds the most Bitcoin?

Surprisingly, BlackRock leads the pack with 345,516 BTC, surpassing Grayscale’s impressive 233,759 BTC holdings. Here’s how the top issuers rank in Bitcoin holdings:

| Issuer | Bitcoin Holdings |

| BlackRock | 3,45,516BTC |

| Grayscale | 2,33,759BTC |

| Fidelity | 1,94,834BTC |

| Ark/21 Shares | 46,021BTC |

| Bitwise | 37,900BTC |

| VanEck | 10,917BTC |

| Valkyrie | 6,360BTC |

| Franklin Templeton | 5,249BTC |

| WisdomTree | 3,494BTC |

Fidelity, with 1,94,834, remains an undeniable presence. Other important issues, with at least 10,000 BTC, are 21Shares (46,021 BTC), Bitwise (37,900BTC), and VanEck(10,917BTC). No other issuer has a BTC holdings worth more than 10,000 BTC.

Bitcoin Spot Issuers’ Changes in BTC Holdings: A Simple Analysis

So now we are aware of the preliminary scenario. Time to enter into its next layer. Here what can be done is to attempt to understand changes in BTC holdings.

| Issuer | Bitcoin Holdings (1D BTC) | Bitcoin Holdings (1D%) | Bitcoin Holdings (7D BTC) | Bitcoin Holdings (7D%) |

| BlackRock (IBIT) | +314.44 BTC | +0.10% | +1183.67 BTC | +0.34% |

| Grayscale (GBTC) | -448.18 BTC | -0.19% | -349.41 BTC | -1.49% |

| Fidelity (FBTC) | +284.00 BTC | +0.16% | +1115.00 BTC | +0.63% |

| Ark/21 Shares (ARKB) | 0 | 0 | +1617.76 BTC | +3.63% |

| Bitwise (BITB) | +201.61 BTC | +0.53% | +196.16 BTC | +0.52% |

| VanEck (HODL) | +683.23 BTC | +6.42% | +615.28 BTC | +5.74% |

| Valkyrie (BRRR) | -0.19 BTC | 0 | -0.43% | 0 |

| Franklin Templeton (EZBC | +406.78 BTC | +6.42% | +423.21 BTC | +6.70% |

| WisdomTree (BTCW) | +218.75 BTC | +6.42% | 196.96 BTC | +5.74% |

In the last seven days, only Grayscale has shown a negative change of -1.46%. The total BTC holdings of Grayscale have decreased by 3409.41 BTC. During this period, the issuer which has gained the most BTC is Ark/21 Shares. Grayscale, with a gain of 1183.67 BTC and Fidelity, with a gain of 1115.00 BTC closely follows. In terms of gain in holding percentage, Franklin Templeton registers the highest gain percentage of 6.70%. VanEck and WisdomTree closely follow with +5.74% ina crease each.

Similarly, in the last 24 hours, none of the top issuers have suffered a reduction, except Grayscale. Its BTC holdings have reduced by around 448.18 BTC.

During this period, the issuer which has gained the highest number of BTC is VanEck, with +682.23BTC. Franklin Templeton closely follows with +406.78 BTC gain. With +314.44 BTC gain, BlackRock stays as the third-best gainer in the said period. However, in terms of gain in percentage, VanEck, Franklin Templeton and WisdomTree are equally good as they mark a 6.42% 24-hour gain each.

Highlights of 2Q24 13-F Filings for US Spot Bitcoin ETFs

Here are the key trends in the Bitcoin Spot ETF sector revealed by the 13-F filings of the second quarter of 2024.

One of the major findings is the sharp increase in the institutional ownership of US Spot Bitcoin ETFs.

Institutional ownership of these ETFs grew from 21.4% to 24.0%. Meanwhile, hedge fund holdings in these ETFS decreased from 37.7% to 30.5%. The proportion of investment advisor holdings is expected to continue increasing as more brokerage firms approve Bitcoin ETFs for their advisors to offer to clients.

Goldman Sachs and Morgan Stanley are named in the report as notable new investors in the Bitcoin Spot ETF sector. As per the report, Goldman Sachs has $412 million in holdings, and Morgan Stanley enjoys $188 million.

Another notable finding of the report is that during the second quarter of 2024, the total Asset Under Management of the Bitcoin Spot ETF sector decreased from $59.3 billion to $51.8 billion. The report observes that this decrease in the AUM was not due to a lack of interest in the Bitcoin Spot ETF sector, but due to a fall in the price of Bitcoin in the period.

Looking Forward: What’s Next for Bitcoin Spot ETFs?

The sharp increase in institutional ownership in Q2 2024 signals a positive trend for the Bitcoin Spot ETF sector. As more institutional players enter the space, the long-term implications for both Bitcoin ETFs and the broader cryptocurrency market remain promising.

Only time will tell how this growing institutional confidence will shape the future of Bitcoin. Stay tuned as the market continues to evolve.

Also Check Out: Bitcoin Price Prediction: Analyst Predicts Rebound to $69K After Recent Dip

Earn more PRC tokens by sharing this post. Copy and paste the URL below and share to friends, when they click and visit Parrot Coin website you earn: https://parrotcoin.net0

PRC Comment Policy

Your comments MUST BE constructive with vivid and clear suggestion relating to the post.

Your comments MUST NOT be less than 5 words.

Do NOT in any way copy/duplicate or transmit another members comment and paste to earn. Members who indulge themselves copying and duplicating comments, their earnings would be wiped out totally as a warning and Account deactivated if the user continue the act.

Parrot Coin does not pay for exclamatory comments Such as hahaha, nice one, wow, congrats, lmao, lol, etc are strictly forbidden and disallowed. Kindly adhere to this rule.

Constructive REPLY to comments is allowed