Bitcoin is on a continuous rise since it touched $52,546 on September 7 last week. At certain points, it looked like BTC was going to fall back; however later it was clear that those dips were merely corrections. There were times when it even moved around 3% down, soon taking a recovery and continuing its upwards journey. Bitcoin even made a Golden Cross-over, but is that going to help it recover? Let’s find out.

Analyzing the Charts

Bitcoin faced a death cross over on August 28 at $61,930. This triggered a fall in its price. Crossing down multiple support levels, Bitcoin finally stopped at $52546. SInce August 28, the price of BTC has been moving under all the moving averages. It started to come over the MAs on September 8 which improved the market sentiment and on September 11 we saw a golden cross over. This is a very positive sign however, it is working to remember that this crossover has happened in hourly charts and hence does not bring that big of a bull surge.

Currently BTC is trading at $58,015 and trying to break resistance created by MA20, just below the major resistance zone of $58,400. This price point has already rejected the price twice in the last two days. If it fails to cross this zone in the third attempt, there are chances that it might fall back to $57,350.

The RSI is creating a negative diversion. It can cause one of the two things here. Either the price will take another dip to justify RSI or the price will consolidate in this area for the next few hours.

Bitcoin Liquidation data

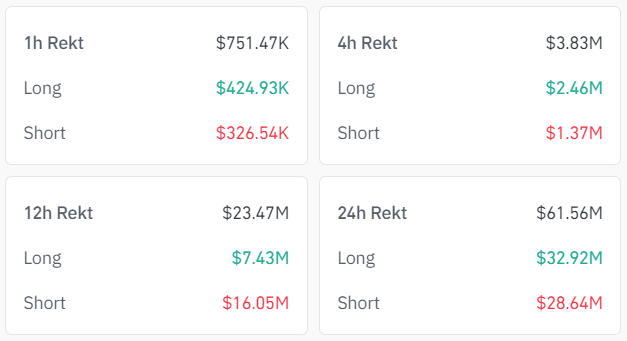

In the last 24 hours a little over 25,000 traders. These trades cost around $61.56 million in liquidation. The liquidation data clarifies that in comparison to short traders who lost $28.66 million, the long traders lost $32.92. Even though the charts are showing that the BTC price is rising, there have been sudden corrections in the market causing these long traders to lose money.

The long-short ratio is positive, representing the confidence of traders that the market is going green. Out of the open perp trades, 57.05% are long on Bitcoin while the rest 42.95 are short selling, bringing the ratio to 1.3283 in positive. Along with this, the Fear and Greed index was recorded at 32, one point risen towards green since yesterday.

Looking Ahead!

The Bitcoin market sentiment is giving out a mixed signal. The chart shows BTC is in a critical zone. The 20 MA is resisting the price rise and RSI showing a negative diversion pointing towards a dip or formation of a consolidation zone. It is very important for the price to close above $58,400 to keep the momentum, however if the price is rejected again, Bitcoin might have to retest the $56,600 support. September is historically a bear month for BTC and if the price falls down, traders should not be surprised.

Earn more PRC tokens by sharing this post. Copy and paste the URL below and share to friends, when they click and visit Parrot Coin website you earn: https://parrotcoin.net0

PRC Comment Policy

Your comments MUST BE constructive with vivid and clear suggestion relating to the post.

Your comments MUST NOT be less than 5 words.

Do NOT in any way copy/duplicate or transmit another members comment and paste to earn. Members who indulge themselves copying and duplicating comments, their earnings would be wiped out totally as a warning and Account deactivated if the user continue the act.

Parrot Coin does not pay for exclamatory comments Such as hahaha, nice one, wow, congrats, lmao, lol, etc are strictly forbidden and disallowed. Kindly adhere to this rule.

Constructive REPLY to comments is allowed