The US economy and the cryptocurrency market are closely connected. Therefore, for crypto traders, it is really important to keep an eye on every US economic development.

In the previous week, the US market experienced a rise of 1.21%. Even though, at one point in the week, the market slipped to a low of $6,284.37, at the time of closing, it had raised to $6,388.64. During the same period, the crypto market saw a drop of around 1.66%.

This week is expected to be an eventful week for the US market. Here are the key events crypto traders should watch for.

Major US Economic Indicators to Watch This Week

1. FOMC Meeting – July 29–30, 2025

The upcoming Federal Open Market Committee (FOMC) meeting will conclude on July 30, with Fed Chair Jerome Powell scheduled to deliver a press conference shortly thereafter.

- Market Expectation: Interest rates are expected to remain steady at 4.25%–4.50%.

- Key Considerations:

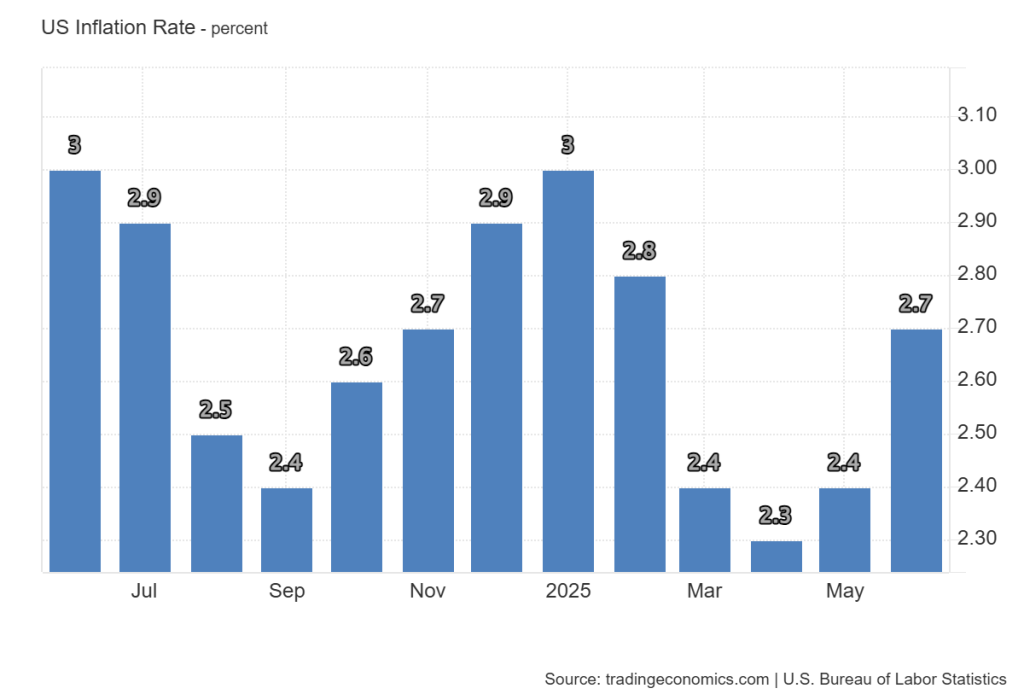

- Inflation has accelerated for the second consecutive month, reaching 2.7% in June.

- Initial jobless claims declined from 221,000 to 217,000, marking the second drop this month.

Potential Crypto Market Impact:

If the Fed maintains its data-dependent stance and signals no immediate cuts, cryptocurrencies may experience muted upward movement. However, continued inflation pressures could reinforce crypto’s appeal as a hedge against currency debasement.

2. Advance Estimate of Q2 GDP – July 30, 2025

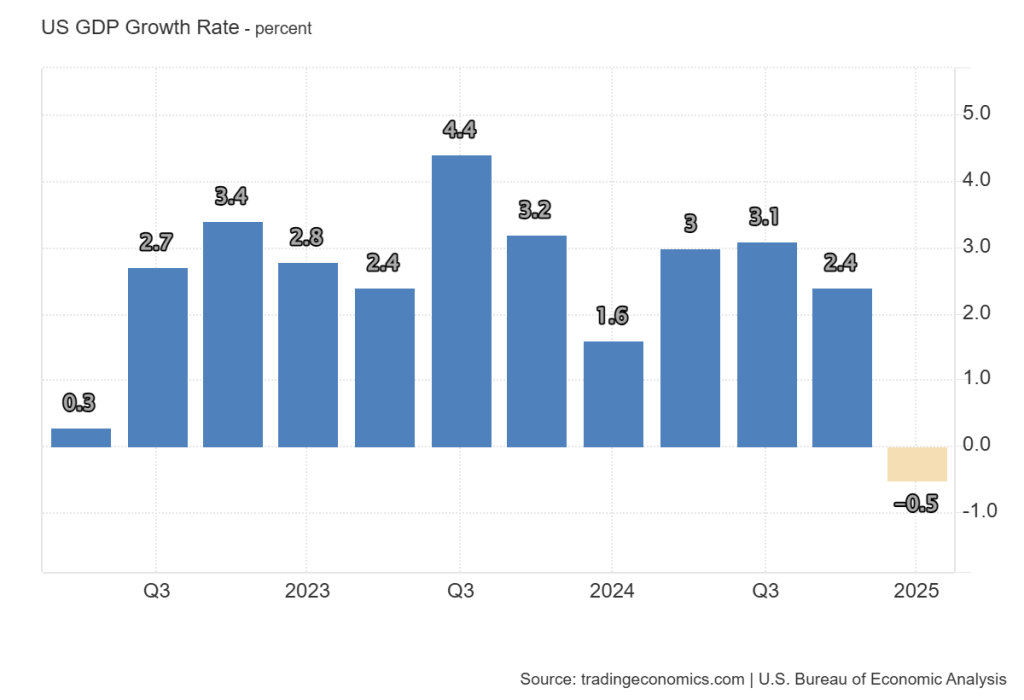

The advance estimate for US Gross Domestic Product (GDP) for the second quarter will also be released on July 30.

- Previous (Q1 2025): -0.5%

- Consensus (Q2 2025): +2.5%

Potential Crypto Market Impact:

A robust GDP rebound could dampen expectations of near-term Fed easing, which may temporarily limit crypto upside. Conversely, it could also reduce recessionary fears and support broader risk appetite, including in digital assets.

3. Non-Farm Payrolls & Unemployment Rate – August 1, 2025

The July employment report, including Non-Farm Payrolls (NFP) and the Unemployment Rate, is scheduled for release on August 1.

- June NFP: 147,000

- Consensus for July: 102,000

- June Unemployment Rate: 4.1%

- Consensus for July: 4.2%

Potential Crypto Market Impact:

Weaker job growth and a modest uptick in unemployment could reinforce expectations of monetary easing later this year. Historically, such conditions have supported inflows into risk assets like Bitcoin and Ethereum, as investors reposition for lower real yields.

Strategic Implications for Crypto Traders

This week’s economic calendar presents multiple catalysts that could significantly influence short-term market direction. Traders and investors should closely monitor the tone of the Fed’s communication, the strength of economic output, and shifts in employment metrics.

Key Takeaways:

- Neutral-to-hawkish Fed stance may temporarily cap crypto gains.

- Stronger-than-expected GDP could pressure digital asset valuations.

- Weaker labor data may rekindle interest in crypto as a speculative hedge.

Conclusion

In a macro-sensitive trading environment, understanding the implications of key US economic data has become essential for informed crypto investing. As the Fed balances inflation control with economic growth, digital assets may offer both risks and opportunities in response to shifting monetary dynamics.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

Earn more PRC tokens by sharing this post. Copy and paste the URL below and share to friends, when they click and visit Parrot Coin website you earn: https://parrotcoin.net0

PRC Comment Policy

Your comments MUST BE constructive with vivid and clear suggestion relating to the post.

Your comments MUST NOT be less than 5 words.

Do NOT in any way copy/duplicate or transmit another members comment and paste to earn. Members who indulge themselves copying and duplicating comments, their earnings would be wiped out totally as a warning and Account deactivated if the user continue the act.

Parrot Coin does not pay for exclamatory comments Such as hahaha, nice one, wow, congrats, lmao, lol, etc are strictly forbidden and disallowed. Kindly adhere to this rule.

Constructive REPLY to comments is allowed