- Lido DAO sustains a three-year accumulation range between $0.85 and $3.20 from 2022.

- Analysts project an $8–$10 top target once LDO breaks above the key $3.20 resistance.

- Strong liquidity, stable staking metrics, and rising volume reinforce LDO’s long-term market strength.

Lido DAO (LDO) is still traded in a structured accumulation range that has lasted over three years. The token is still one of the most significant Ethereum-related assets, which is backed by active market activity, stable liquidity, and solid staking fundamentals. Current data reflects a constructive setup for future expansion toward a projected top range of $8–$10.

Daily Market Overview and Performance Data

As per the CoinMarketCap data, Lido DAO was trading at $1.22, which is an increment of 1.68% over the past 24 hours. The value of the market capitalization of the project increased 2.31% to an amount of $1.1 billion within the period. The fully diluted valuation (FDV) remained at $1.23 billion, showing alignment with the circulating supply.

The 24-hour trading volume stood at $158.5 million, with a 81.55% increment over the past day. The volume-to-market-cap ratio was 14.51% which reaffirmed active trading across the exchanges. The total value locked (TVL) in Lido reached $39.86 billion, maintaining its position among the largest Ethereum staking platforms.

Price activity throughout the trading session displayed steady upward movement with fluctuations between $1.20 and $1.28. LDO started at around $1.2011, went to a high of about $1.28 daily and then settled around within the range of $1.23-$1.26. The price remained above $1.22 despite minor retracements in the last update.

Three-Year Accumulation Range Analysis

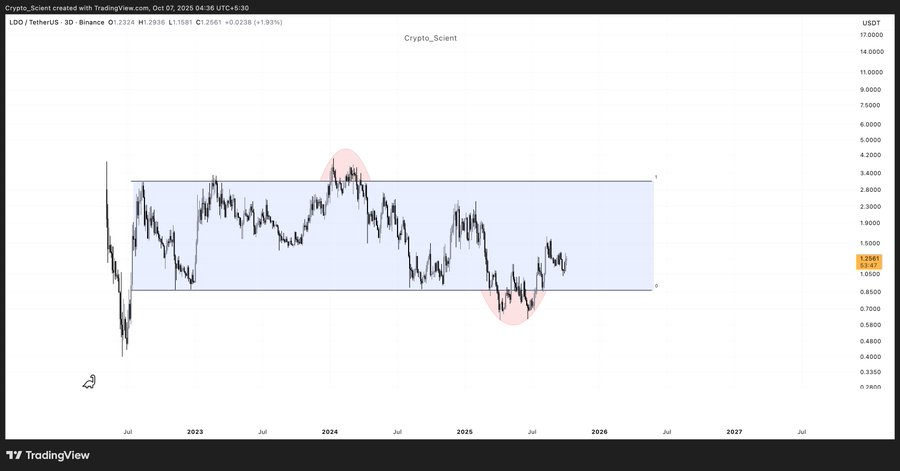

According to analysis prepared by Crypto_Scient, the LDO/USDT chart on a three-day timeframe shows a horizontal consolidation between $0.85 and $3.20 since mid-2022. The structure represents a multi-year accumulation pattern where each rally toward $3.20 meets resistance, and retracements near $0.85 attract renewed buying activity.

Price data records an early decline in 2022, followed by stabilization and range formation. In the year 2024, there was a double-top formation towards the resistance, and a rounded bottom was formed towards mid-2025 towards support. Since then, price action has shown higher lows within the same horizontal channel, reinforcing long-term accumulation pressure.The chart identifies Lido DAO as one of the major Ethereum beta assets maintaining historical price symmetry. With current prices near $1.25, the asset remains within the accumulation range. Based on the measured range height, analysts consider $8–$10 a reasonable top target following a potential breakout above $3.20.

Earn more PRC tokens by sharing this post. Copy and paste the URL below and share to friends, when they click and visit Parrot Coin website you earn: https://parrotcoin.net0

PRC Comment Policy

Your comments MUST BE constructive with vivid and clear suggestion relating to the post.

Your comments MUST NOT be less than 5 words.

Do NOT in any way copy/duplicate or transmit another members comment and paste to earn. Members who indulge themselves copying and duplicating comments, their earnings would be wiped out totally as a warning and Account deactivated if the user continue the act.

Parrot Coin does not pay for exclamatory comments Such as hahaha, nice one, wow, congrats, lmao, lol, etc are strictly forbidden and disallowed. Kindly adhere to this rule.

Constructive REPLY to comments is allowed