The recent surge in Bitcoin price has left investors closely watching its performance as it decouples from traditional markets. For context, as the U.S. heads toward the upcoming crypto-focused election, the flagship asset appears to have found independence from the S&P 500 and is making waves. This co-relation, as highlighted by MicroStrategy’s Michael Saylor and fueled by the recent robust performance of BTC, has sparked discussions in the broader market.

Michael Saylor Reacts As Bitcoin Decouples From S&P 500

Recently, Bitcoin broke its long-standing correlation with the S&P 500, gaining attention from investors. Historically, the crypto moved in tandem with major US indices, but this trend has shifted over the past few days.

On Wednesday, reports surfaced that the U.S. administration is considering a foreign direct product rule to control chip equipment exports to China. This development, coupled with Donald Trump’s remarks on Taiwan’s payment for U.S. protection, caused turbulence in financial markets.

On the other hand, major stocks, including CrowdStrike, experienced disruptions, affecting banks, airlines, and hospitals. However, Bitcoin has shown strong resilience gaining strong inflows from ETFs and Trump’s comments on possibly using BTC as U.S. strategic reserves.

Meanwhile, the U.S. government holds around 213,000 BTC, according to reports. These factors created a perfect storm for the crypto to break free from traditional market trends. If the largest crypto by market cap continues to rise while US markets falter, it might be seen as a new safe-haven asset, potentially leading to moderate gains.

Also Read: Bitcoin Mining Stocks May Soon Outperform BTC In Near Term, Here’s Why

What’s Next?

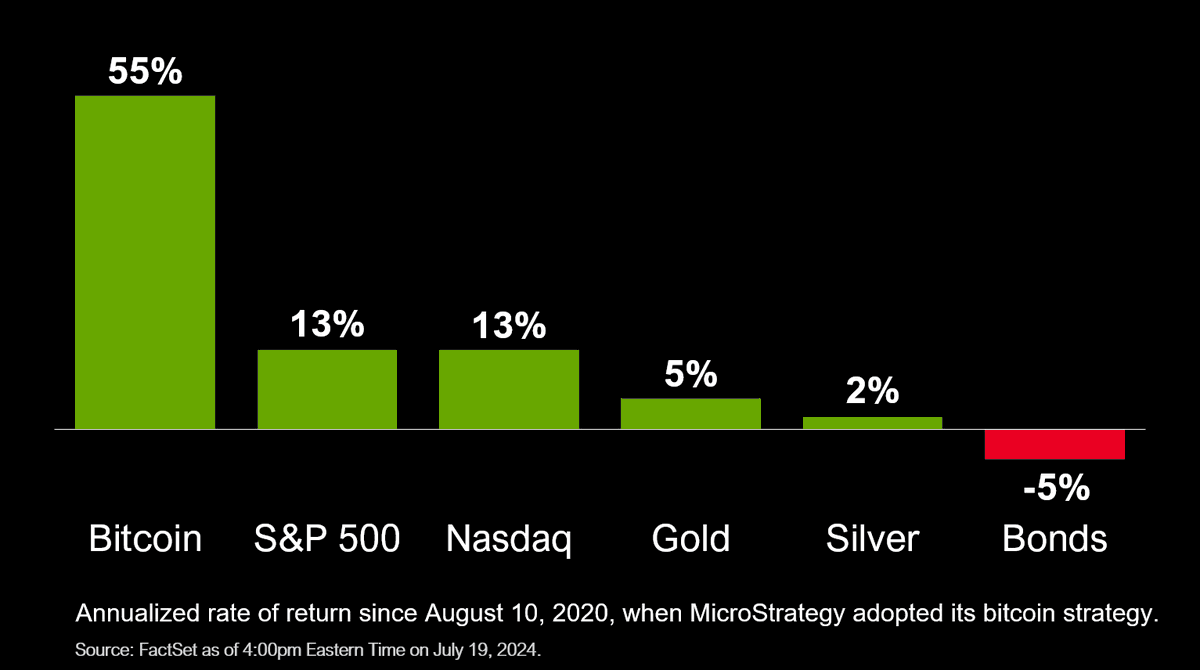

Sharing a chart on the X platform recently, MicroStrategy Founder Michael Saylor has lauded Bitcoin’s rally since 2020. For context, the chart that he shared showed the exact returns of BTC and other traditional markets since August 10, 2020, when MicroStrategy adopted its BTC Strategy.

According to the report, BTC has shown gains of 55% since then, while the S&P 500 and Nasdaq returned 13% gains each. On the other hand, Gold and Silver saw a surge of only 5% and 2%, respectively, in the same time gap.

The sustainability of the crypto decoupling from the S&P 500 will be closely monitored. The next week will be critical in determining whether this trend holds and how it affects the broader cryptocurrency market.

Meanwhile, Bitcoin’s decoupling from the S&P 500 amid market turbulence and potential pro-crypto policies has positioned it as a possible new safe-haven asset. This shift has significant implications for the future of crypto investments and the broader financial landscape. As the election approaches, BTC’s performance will be a key indicator to watch.

During writing, BTC price was up over 1% and exchanged hands at $67,554.22, after touching an intraday high of $68,480.06. Furthermore, its trading volume also rose 90% to $34.39 billion from yesterday, hinting at increasing trading activity.

Also Read: TON Blockchain Partners Mocaverse & MOCA Foundation, Here’s Why

The post Michael Saylor Highlights Bitcoin Supremacy Over S&P 500 appeared first on CoinGape.

Earn more PRC tokens by sharing this post. Copy and paste the URL below and share to friends, when they click and visit Parrot Coin website you earn: https://parrotcoin.net0

PRC Comment Policy

Your comments MUST BE constructive with vivid and clear suggestion relating to the post.

Your comments MUST NOT be less than 5 words.

Do NOT in any way copy/duplicate or transmit another members comment and paste to earn. Members who indulge themselves copying and duplicating comments, their earnings would be wiped out totally as a warning and Account deactivated if the user continue the act.

Parrot Coin does not pay for exclamatory comments Such as hahaha, nice one, wow, congrats, lmao, lol, etc are strictly forbidden and disallowed. Kindly adhere to this rule.

Constructive REPLY to comments is allowed