PCE Inflation: Stock and crypto market traders wait for the release of the US Federal Reserve’s preferred inflation gauge PCE for further bullish cues. The U.S. Bureau of Economic Analysis to release the personal consumption expenditure (PCE) price index today and economists see PCE inflation slowing for a second consecutive month to 2.5% from 2.6%, making the FOMC to discuss interest rate cuts.

Federal Reserve officials have recently shared their dovish outlook on monetary policy, hinting at a pivot to rate cuts. The market expects the first rate cut by the U.S. Fed in September.

Wall Street Estimates On PCE Inflation Data

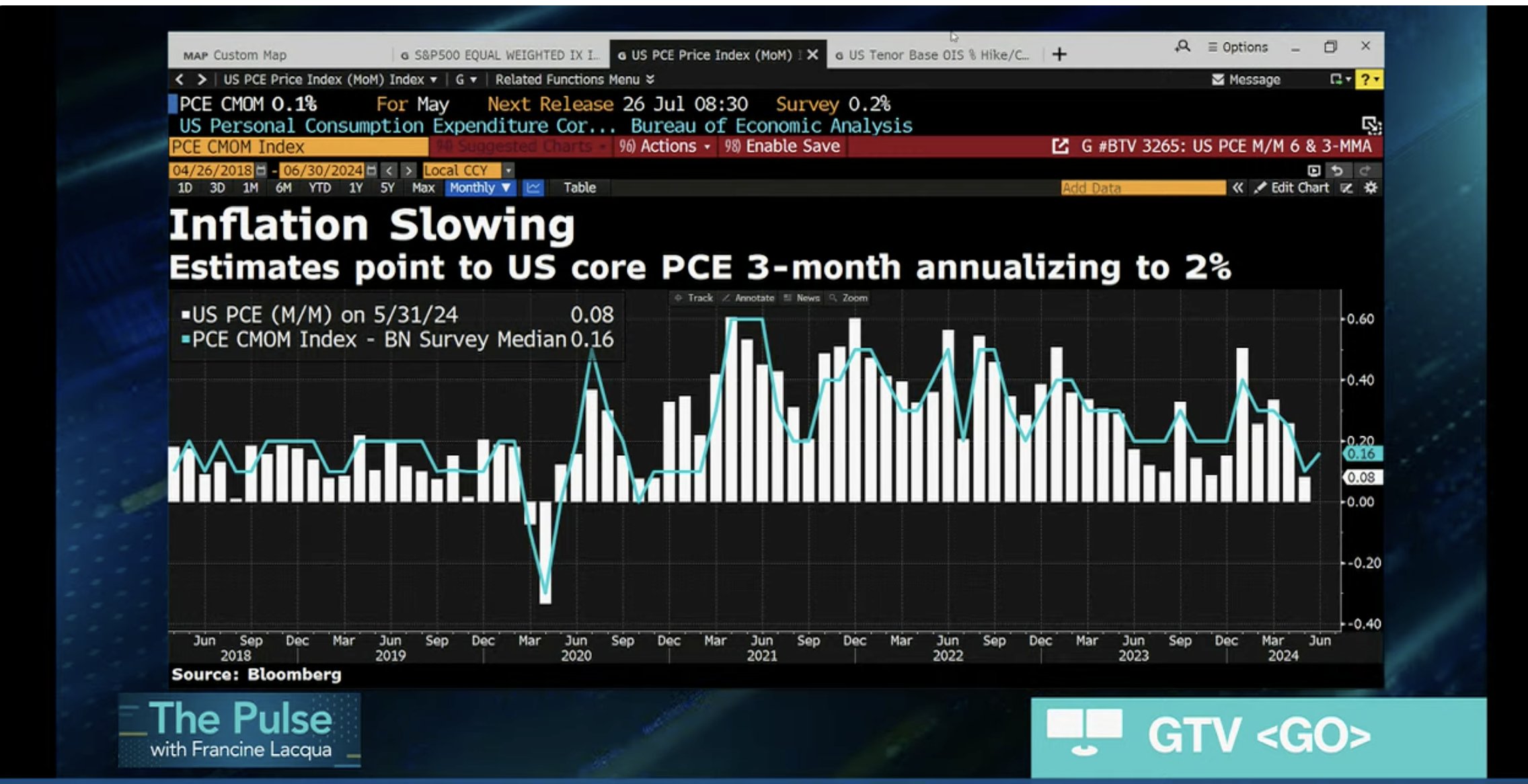

The PCE inflation is expected to cool further as per the latest analysis by economists. The market expects annual PCE to fall to 2.5%, down from 2.6% last month. Similarly, the annual core PCE inflation is projected to decrease to 2.5%, a new low since March 2021, from 2.6%.

In addition, the monthly PCE inflation is expected at 0.1% while the monthly core PCE is also anticipated to come in at 0.1%. Notably, the Federal Reserve’s latest economic projections estimated annual PCE inflation at 2.6% and the core rate at 2.8% for the current year.

Wall Street giants including JPMorgan, Morgan Stanley, Bank of America, Goldman Sachs, Nomura, and UBS have estimated a median forecast of 2.5% y/y and 0.1% m/m. Meanwhile, the banks estimate core PCE inflation to come in at 2.5%, in line with the market forecast. Also, the estimates point to US core PCE 3-month annualizing to 2%, reaching the target rate of the Federal Reserve.

Also Read: LUNC Delisting – Terra Classic Seeks Clarification From TFL CEO And eToro

Bitcoin and Crypto Market Prepares for Rally

According to Morgan Stanley, “Considerable progress on inflation allows the Fed to inch closer to rate cuts. Chair Powell should emphasize increased confidence.”

Morgan Stanley joined Goldman Sachs to predict three cuts this year starting in September. They expect Fed Chair Jerome Powell to continue indicating that the Fed is nearing a decision to lower rates, without committing to a specific timeline.

BTC price jumped 5% in the last 24 hours as the Bitcoin Conference fueled bullish sentiment. The price is currently trading over $67,300, with the 24-hour low and high of $63,473 and $67,466, respectively. Furthermore, the trading volume has increased slightly in the last 24 hours, indicating a rise in interest among traders.

Meanwhile, the US dollar index (DXY) is moving near 104.38, with a further drop expected due to anticipation of Donald Trump’s win in the presidential election. Moreover, the US 10-year Treasury yield dropped to 4.244% today. As Bitcoin moves opposite to DXY and Treasury yields, the pressure is reducing.

Also Read: Bitcoin Conference – Donald Trump Refuses To Debate With Kamala Harris

The post PCE Inflation: Wall Street & Economists Estimate Fed Rate Cuts Timeline appeared first on CoinGape.

Earn more PRC tokens by sharing this post. Copy and paste the URL below and share to friends, when they click and visit Parrot Coin website you earn: https://parrotcoin.net0

PRC Comment Policy

Your comments MUST BE constructive with vivid and clear suggestion relating to the post.

Your comments MUST NOT be less than 5 words.

Do NOT in any way copy/duplicate or transmit another members comment and paste to earn. Members who indulge themselves copying and duplicating comments, their earnings would be wiped out totally as a warning and Account deactivated if the user continue the act.

Parrot Coin does not pay for exclamatory comments Such as hahaha, nice one, wow, congrats, lmao, lol, etc are strictly forbidden and disallowed. Kindly adhere to this rule.

Constructive REPLY to comments is allowed