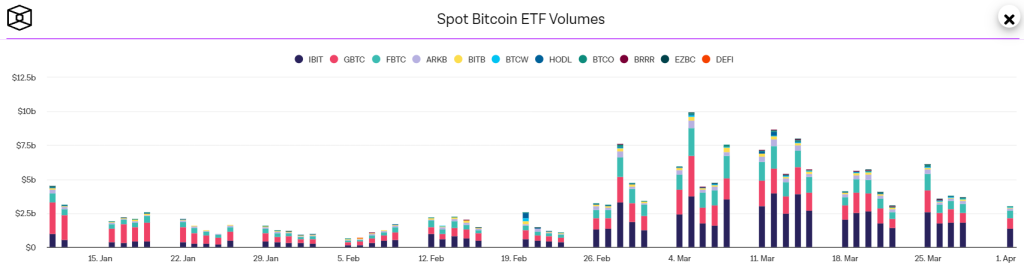

Spot Bitcoin ETFs had a big role in maintaining the bull run in March, resulting in new ATH for BTC price. On-chain data reveals that the trading volume for spot Bitcoin Exchange-Traded Funds (ETFs) increased by $111 billion in March. This figure nearly triples the trading volume observed in February, strengthening the bullish confidence amid massive institutional interest.

Spot Bitcoin ETF Trading Volume Touched $185 Billion

The primary factor driving Bitcoin’s significant increase in March, reaching a new all-time high, was the impressive volume of inflows into ETFs. Consequently, the on-chain data for spot Bitcoin ETFs in March showed promising results.

According to data, the trade volume for spot Bitcoin ETFs soared to an impressive $111 billion in March, almost tripling the $42.2 billion recorded in February, as per data displayed on The Block Data Dashboard. With February being the inaugural full month of trading following their introduction on January 11, the robust uptick in March highlights the rising institutional interest for Bitcoin.

Eric Balchunas, a Senior ETF Analyst with Bloomberg, took to the social media platform X to point out the significance of the surge in trading volume last month.

“Bitcoin ETFs traded $111b in March, which is just about triple what they did in Feb and Jan. I added the months where only GBTC was on market for further context. I can’t imagine April will be bigger but who knows”, said Eric.

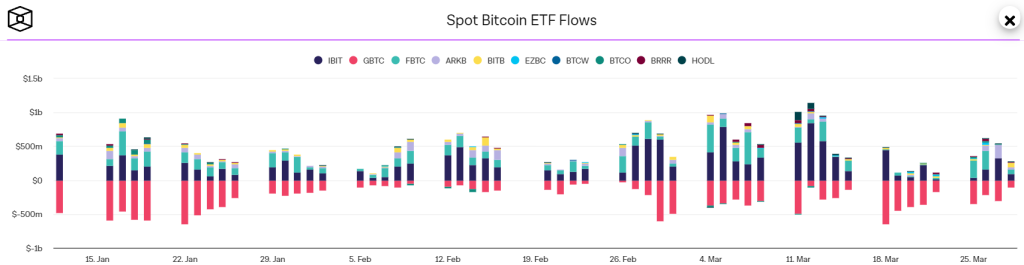

The trio of spot ETFs from Grayscale, BlackRock, and Fidelity remains at the top of trading activity. However, after Monday’s session, it was noted that Grayscale’s GBTC fund experienced over $15 billion in total outflows since its launch in January. When measured in Bitcoin, the GBTC fund, which Grayscale transformed into a spot Bitcoin ETF two months back after operating as a trust for ten years, has seen a decline of 46%. This reduction brought its holdings from approximately 619,000 BTC down to 333,619 BTC, valued at $22 billion, according to CoinGlass data.

Spot Bitcoin ETF Sentiment Ahead Of Halving Event

On Monday, exchange-traded funds (ETFs) based on spot Bitcoin experienced withdrawals as Bitcoin fell below the $67,000 mark. Investment analysis from Farside highlighted that Grayscale’s Bitcoin ETF, known as GBTC, witnessed a notable increase in outflows, exceeding $300 million on the same day. The total net withdrawals from Bitcoin spot ETFs amounted to $85.84 million, largely due to the substantial withdrawals from GBTC. Conversely, BlackRock’s ETF, IBIT, saw a net addition of $165 million, while Fidelity’s ETF, FBTC, enjoyed a net increase of $43.99 million.

As the Bitcoin halving event nears, concerns grow about April’s ETF inflows’ stability. However, analysts believe that a drop in Bitcoin might not harm ETF figures, anticipating a rise in purchases as prices drop. This decrease may trigger a price rebound in the coming weeks, attracting interest from both institutional and retail investors.

Earn more PRC tokens by sharing this post. Copy and paste the URL below and share to friends, when they click and visit Parrot Coin website you earn: https://parrotcoin.net0

PRC Comment Policy

Your comments MUST BE constructive with vivid and clear suggestion relating to the post.

Your comments MUST NOT be less than 5 words.

Do NOT in any way copy/duplicate or transmit another members comment and paste to earn. Members who indulge themselves copying and duplicating comments, their earnings would be wiped out totally as a warning and Account deactivated if the user continue the act.

Parrot Coin does not pay for exclamatory comments Such as hahaha, nice one, wow, congrats, lmao, lol, etc are strictly forbidden and disallowed. Kindly adhere to this rule.

Constructive REPLY to comments is allowed