Ethereum may be under pressure on the charts, but behind the scenes, bullish signals are rapidly stacking up. Despite a 1.82% drop today and a 26.75% decline over the past year, a prominent crypto analyst known as Unipcs—also referred to as “Bonk Guy“—has outlined several key factors that could spark a powerful ETH rally.

Ethereum ETFs See Massive Inflows

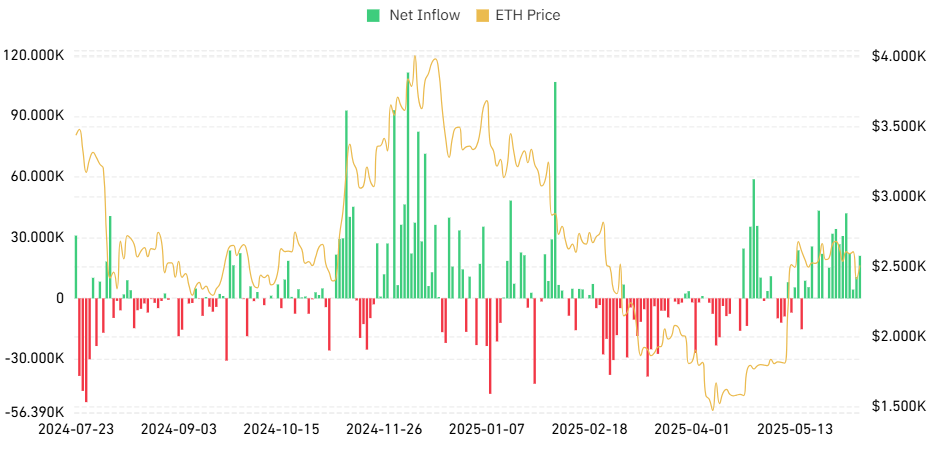

One of the most bullish trends cited by Bonk Guy is the consistent inflow into Ethereum exchange-traded funds (ETFs).

According to Coinglass data, ETH ETFs have now posted 15 consecutive days of positive inflows.

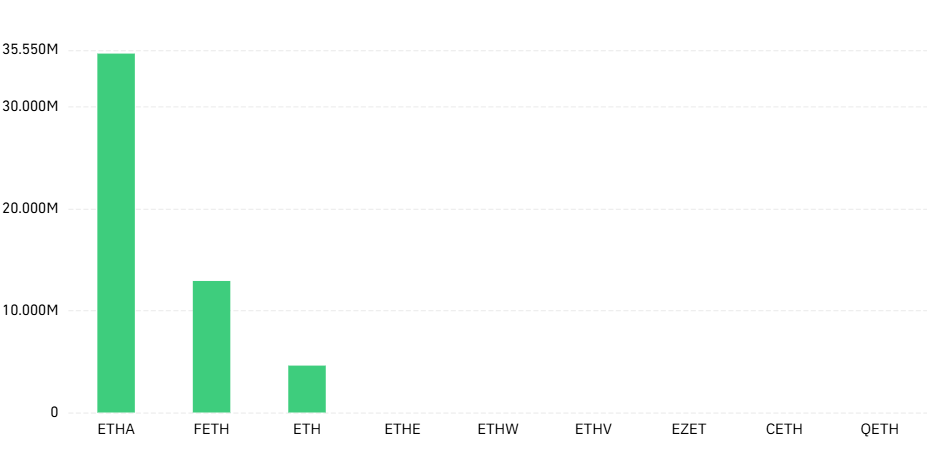

- BlackRock’s ETHA led with $35.2 million in a single day

- Fidelity’s FETH followed with $12.9 million

- Grayscale’s ETH added $4.6 million

On June 3 alone, ETH ETFs recorded a massive $109.5 million in inflows—marking the highest single-day inflow for Ethereum ETFs so far this month.

Corporates Are Holding Ethereum

Bonk Guy notes a shift among institutions adopting Ethereum as a treasury asset. In a headline-grabbing move, SharpLink Gaming closed a $425 million private placement, led by ConsenSys Software Inc, to implement one of the largest Ethereum treasury strategies in public markets.

This signals growing corporate confidence in ETH, mirroring the Bitcoin-focused approach seen with MicroStrategy.

ETH Staking Approval in ETFs May Be Near

Regulatory signals suggest that ETH staking could soon be allowed in ETF structures. If approved, it could unlock significant institutional inflows and act as a major bullish catalyst for Ethereum.

Short Squeeze Ahead?

The analyst also pointed out that many funds and traders are currently shorting ETH. Should the price reverse upward, it could trigger a short squeeze, amplifying gains as traders rush to cover positions.

Meanwhile, weekly active Ethereum addresses have hit record highs, showing surging user engagement and strengthening the case for long-term growth.

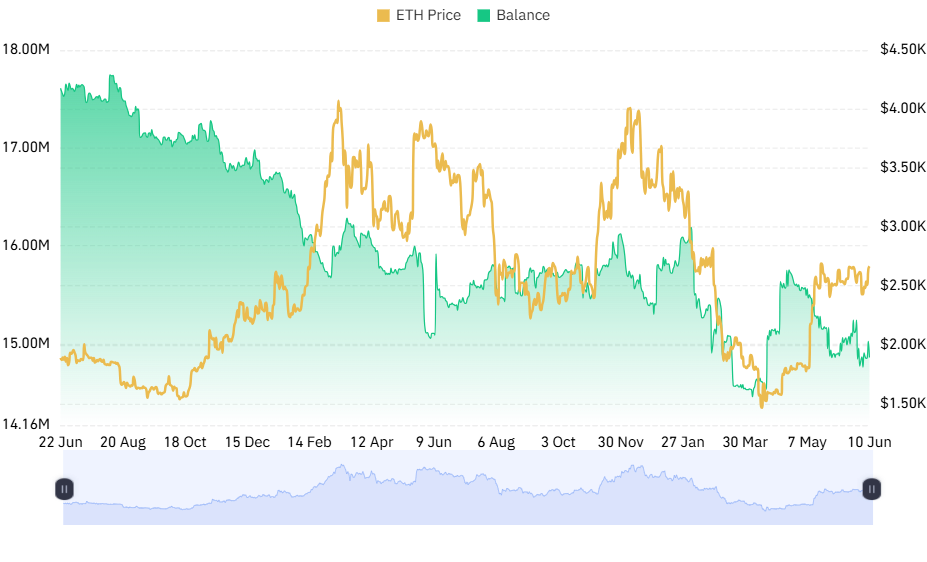

ETH Supply on Exchanges Is Shrinking

Ethereum supply on exchanges is dropping fast—a sign that traders are moving assets to cold storage or staking, reducing sell pressure.

Notable 30-day ETH outflows include:

- Bitfinex: -572,946 ETH

- Coinbase Pro: -2,149 ETH

- OKX: -13,627 ETH

- Kraken: -6,428 ETH

- Bithumb: -19,572 ETH

In total, top exchanges including Binance and Coinbase saw a combined decline of over 261,000 ETH.

All-Time High Staking and Layer 2 Boom

The Ethereum ecosystem is also expanding, with over 34.6 million ETH now staked, locking up a significant portion of supply.

Moreover, Layer 2 networks like Base are showing explosive growth, pointing to increasing scalability and mainstream adoption.Bottom Line: While Ethereum’s price performance may look disappointing in the short term, on-chain data, ETF inflows, treasury adoption, and growing network activity all hint at a potential breakout rally on the horizon.

Never Miss a Beat in the Crypto World!

Stay ahead with breaking news, expert analysis, and real-time updates on the latest trends in Bitcoin, altcoins, DeFi, NFTs, and more.

Earn more PRC tokens by sharing this post. Copy and paste the URL below and share to friends, when they click and visit Parrot Coin website you earn: https://parrotcoin.net0

PRC Comment Policy

Your comments MUST BE constructive with vivid and clear suggestion relating to the post.

Your comments MUST NOT be less than 5 words.

Do NOT in any way copy/duplicate or transmit another members comment and paste to earn. Members who indulge themselves copying and duplicating comments, their earnings would be wiped out totally as a warning and Account deactivated if the user continue the act.

Parrot Coin does not pay for exclamatory comments Such as hahaha, nice one, wow, congrats, lmao, lol, etc are strictly forbidden and disallowed. Kindly adhere to this rule.

Constructive REPLY to comments is allowed