Following several announcements regarding tariffs by Donald Trump, the crypto market has faced increased downward volatility. As a result, the price of Ethereum (ETH) dropped below the critical $2,000 mark, leading to a surge in long liquidations. Amid this, various on-chain metrics for Ethereum turned bearish, suggesting a drop in accumulation. However, analysts anticipate a strong rebound in the price of ETH ahead of the upcoming crypto summit.

Whale Pressure Drops Amid ETH’s Dip

Recent data from Coinglass shows equal trading activity as Ethereum remains under the $2,500 mark. In the past 24 hours, Ethereum faced a total liquidation of approximately $47.87 million, with buyers liquidating $28.1 million and sellers closing $19.7 million in short positions.

In the meantime, key investors are utilizing the opportunity to purchase Ethereum at lower prices, especially ahead of the upcoming White House Crypto Summit. Traders are particularly focused on the activity of wallet addresses associated with Trump-endorsed World Liberty Financial (WLF).

Also read: Trump’s WLFI Buys $10M in Ethereum Despite Losses – Here’s Why

According to Arkham Intel, an on-chain intelligence firm, WLF’s wallet has tripled its Ether holdings within just one day. WLF has been actively buying up Ethereum during recent price dips. Reports from Arkham Intel reveal that as of Thursday, WLF holds approximately 7,100 Ethereum tokens, valued at over $80 million. This substantial increase from 2,500 tokens in just 24 hours highlights a strong accumulation strategy.

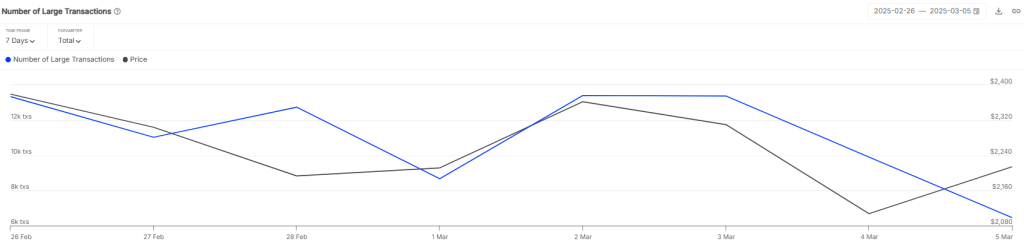

Data from IntoTheBlock reveals a significant decline in whale activity for Ethereum, coinciding with considerable losses due to Ethereum’s price drop. The count of whale transactions has notably decreased, falling from a high of 13.4K transactions to just 6.46K. Furthermore, there has been a drastic drop in the volume of large transactions, which plummeted from $11 billion to $5.5 billion.

This decline in whale pressure came following a negative trend in large holders’ unrealized profit. CryptoQuant data indicates that ETH whales, specifically those with holdings ranging from 1,000 to 10,000 ETH and from 10,000 to 100,000 ETH, have experienced a shift to negative unrealized profits.

What’s Next for ETH Price?

The ETH price recovered toward $2,300 as it faced buying pressure. However, it failed to surge further as bears strongly defended the resistance level. As of writing, Ethereum price trades at $2,200, dropping over 0.9% in the last 24 hours.

The ETH/USDT trading pair is struggling to approach the immediate resistance line at $2,530. This level could be a major obstacle as STHs might continue to liquidate here. However, buyers might soon break above that level as demand surges.

If the price holds below the EMA20 trend line on the 1-hour chart, the sellers will likely try to push it back down to $2K.

However, with the RSI level continuing to trade around the midline at level 45, it might trigger a retest of the resistance channel. If the price manages to hold above $2,530, it would favor the buyers. The trading pair could then increase to $2,935.

Earn more PRC tokens by sharing this post. Copy and paste the URL below and share to friends, when they click and visit Parrot Coin website you earn: https://parrotcoin.net0

PRC Comment Policy

Your comments MUST BE constructive with vivid and clear suggestion relating to the post.

Your comments MUST NOT be less than 5 words.

Do NOT in any way copy/duplicate or transmit another members comment and paste to earn. Members who indulge themselves copying and duplicating comments, their earnings would be wiped out totally as a warning and Account deactivated if the user continue the act.

Parrot Coin does not pay for exclamatory comments Such as hahaha, nice one, wow, congrats, lmao, lol, etc are strictly forbidden and disallowed. Kindly adhere to this rule.

Constructive REPLY to comments is allowed