The Fed minutes for its September meeting have further dampened hopes for a 50 basis points (bps) rate cut in November. This provides a bearish outlook for the Bitcoin price, considering the market was already pricing into a 50 bps rate cut following Fed Chair Jerome Powell’s dovish speech following the September FOMC meeting.

Fed Minutes For September Meeting To Cause More Uncertainty

The Fed September minutes will cause more uncertainty in the market, which doesn’t favor the Bitcoin price. Before now, market participants confidently predicted that the US Federal Reserve would cut interest rates by another 50 bps at its November FOMC meeting.

However, the September FOMC minutes show that market participants can’t be too confident about a rate cut, much less a 50 bps rate in November. The Fed officials stated at the FOMC meeting that they would continue to monitor the “implications of incoming information for the economic outlook” in assessing the appropriate stance of monetary policy.

The Committee added that they would be prepared to adjust monetary policy as appropriate if any risks arose that could impede their goal of achieving 2% inflation.

According to the Fed minutes, the Committee’s assessments will consider a wide range of information. This will include readings on “labor market conditions, inflation pressures and inflation expectations, and financial and international developments.”

Part of the information that the Fed will focus on includes the Consumer Price Index (CPI) inflation data, which will come out tomorrow. The US CPI data was already in focus, as the US Jobs data, which came out last week, dampened hopes about a 50 bps rate cut.

The Fed September minutes have only further dampened these hopes, leaving traders uncertain about whether to allocate more capital to the flagship crypto. Such market uncertainty isn’t good for the Bitcoin price since investors will be apprehensive about investing during this period.

Upcoming US Presidential Elections Also Another Factor

The fast-approaching US presidential is also contributing to the current uncertainty in the market. Besides the Fed minutes and whether or not there will be rate cuts in November, investors are also wary about the potential outcome of the elections.

The market typically witnesses a lot of volatility during this period, which explains why many investors may opt for capital preservation. Interestingly, Bernstein analysts predict the Bitcoin price could enjoy an upward trend ahead of the elections if Donald Trump’s chances at the polls increase.

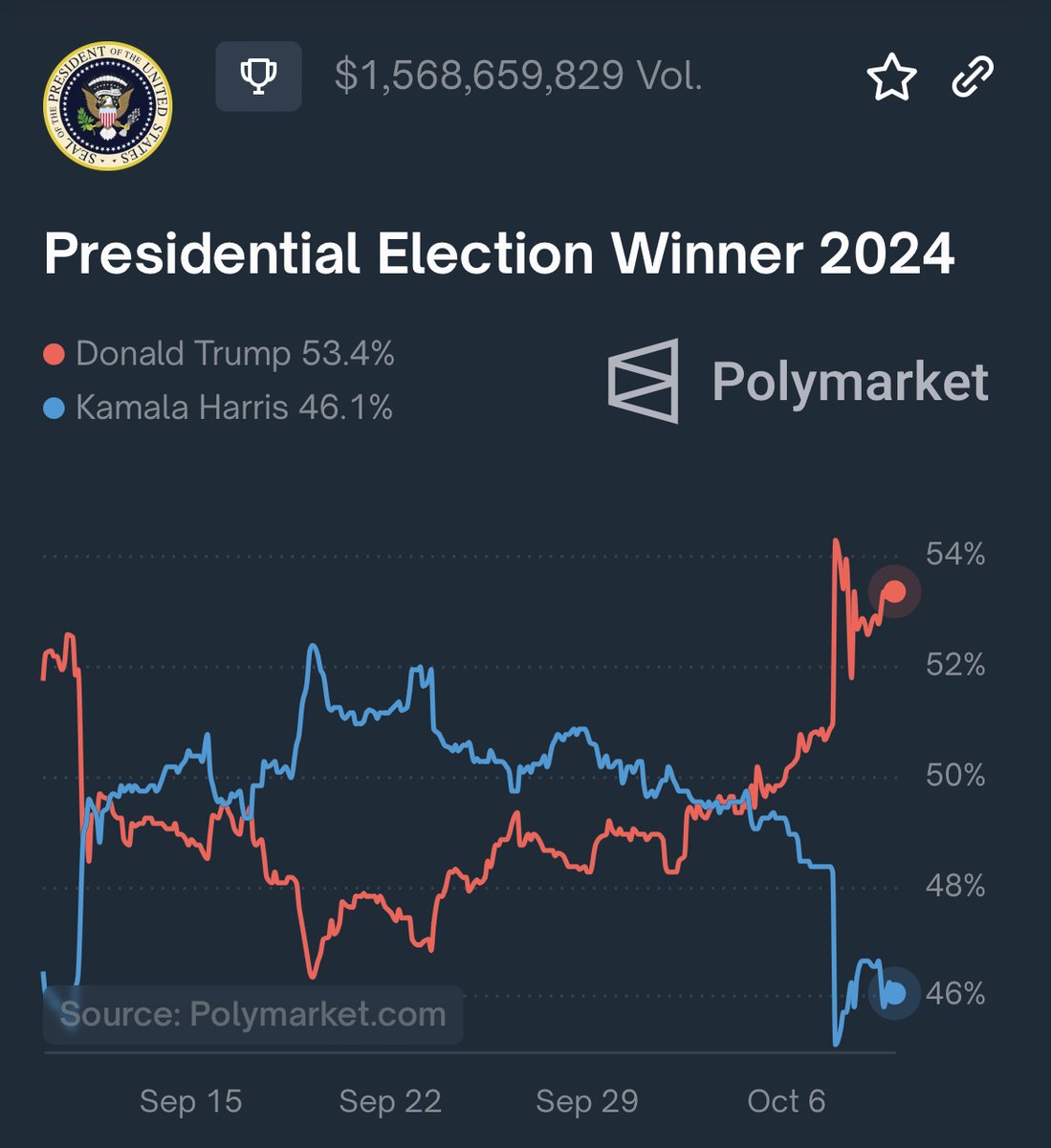

The latest Polymarket odds show that Donald Trump is up by over 7%, with the former US president boasting a 53% chance of becoming the next US president, while Kamala Harris’s odds are at 46%. These Berstein analysts say that the BTC price could reach as high as $90,000 if Trump eventually wins.

However, history suggests that BTC will reach a new all-time high (ATH) after the elections, regardless of who wins the elections. According to the Fed minutes, the November FOMC meeting will start on the 6th, just a day after the US elections.

Meanwhile, it is worth mentioning that veteran trader Peter Brandt predicted a BTC rally to $135,000 by August or September 2025. This is around the period BTC could peak in this market cycle.

The post What Does The Fed Minutes Mean For The Bitcoin Price? appeared first on CoinGape.

Earn more PRC tokens by sharing this post. Copy and paste the URL below and share to friends, when they click and visit Parrot Coin website you earn: https://parrotcoin.net0

PRC Comment Policy

Your comments MUST BE constructive with vivid and clear suggestion relating to the post.

Your comments MUST NOT be less than 5 words.

Do NOT in any way copy/duplicate or transmit another members comment and paste to earn. Members who indulge themselves copying and duplicating comments, their earnings would be wiped out totally as a warning and Account deactivated if the user continue the act.

Parrot Coin does not pay for exclamatory comments Such as hahaha, nice one, wow, congrats, lmao, lol, etc are strictly forbidden and disallowed. Kindly adhere to this rule.

Constructive REPLY to comments is allowed