The BTC price USD trades within a subdued range shows its hard struggle to regain its momentum back, clearly reflecting a broader shift in global risk appetite. Bitcoin still remains structurally intact in longterm, but capital is aggressively flowing into precious metals that are strongly responsible for delaying upside catalysts for BTC price despite clear signs of long-term accumulation.

Liquidity Rotation Explains Why BTC Price Is Lagging

At present, macro liquidity dynamics offer a clearer explanation for Bitcoin’s underperformance than technical weakness. Some market observers highlight that strong Chinese liquidity historically favors GOLD, while periods of expanding U.S. liquidity tend to support BTC crypto. Current conditions, however, continue to tilt toward defensive capital allocation.

Asgeopolitical tensions and economic uncertainty persist, investors are in total risk-off sentiment and avoiding the worst by prioritizing capital preservation. That’s what makes Gold and SILVER strongly favourable, as they are long viewed as traditional stores of value and as a result it has naturally attracted large inflows. Central banks and institutional players have also increased exposure to precious metals, pushing prices toward record levels while risk assets remain sidelined.

Gold and Silver Lead During Defensive Market Phases

In environments dominated by caution, capital rotation typically favors assets perceived as stable and non-correlated. Although Bitcoin often carries the “digital gold” narrative, the market still treats it largely as a risk asset, similar to equities. As a result, shortterm BTC price forecast narratives remain constrained during risk-off cycles.

Historically, precious metals tend to absorb liquidity first when fear spikes. Only after volatility subsides does capital rotate back into higher-beta assets like Bitcoin. That pattern appears intact. For now, the strength in XAU/USD and XAG/USD has delayed meaningful upside for the BTC price chart.

Silver’s Extreme Volatility Highlights Capital Movement

Recent price action in SILVER has underscored the scale of liquidity currently bypassing crypto markets. According to market data, Silver swung nearly $2 trillion in market capitalization within just 24 hours.

Between 9:00 AM and 1:00 PM ET, SILVER added approximately $500 billion in market value. That was followed by a $950 billion drawdown by 4:30 PM ET, before rebounding with another $500 billion inflow later in the session.

Such volatility highlights how capital is rapidly rotating within precious metals rather than flowing into BTC crypto during the current defensive phase.

BTC Price Structure Remains Supported by Accumulation

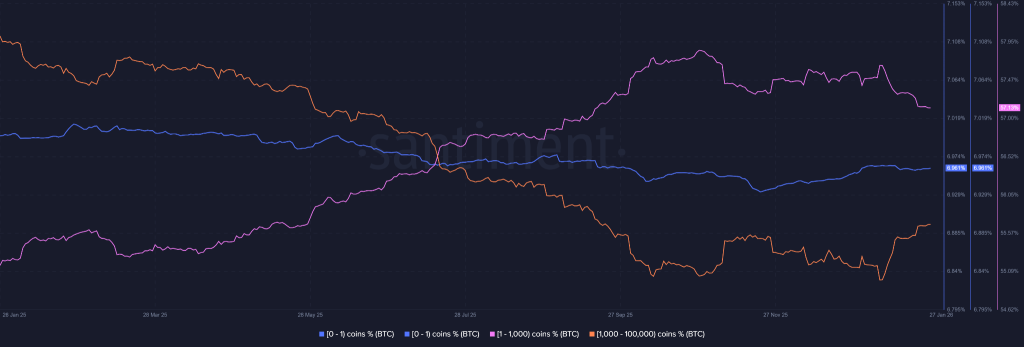

Despite the lagging BTC price USD, on-chain supply data suggests selling pressure remains limited. Wallets holding between 1,000 and 100,000 BTC continue to accumulate at notable levels. Interestingly, even the smallest holders addresses holding 0 to 1 BTC are adding exposure, reinforcing a broader accumulation trend.

Meanwhile, addresses holding 1 to 1,000 BTC appear to be the primary sellers. However, their distribution is being absorbed by both retail participants and larger holders. This pattern often appears during consolidation phases, when price underperforms fundamentals.

From an analytical standpoint, this supply behavior indicates that once capital rotation begins away from precious metals, BTC price may respond rapidly as sidelined demand re-enters the market.

Capital Rotation May Define the Next BTC Price Phase

That said, continued strength in GOLD and SILVER could still pressure BTC price prediction narrative in the near term. If precious metals extend higher, Bitcoin may remain range-bound or experience modest downside without signaling structural weakness.

However, elevated metal prices also increase vulnerability to profit-taking. When that occurs, historical rotation patterns suggest capital tends to migrate toward assets like Bitcoin, Ethereum, and other alt’s. With institutional participation and government-linked accumulation still active, downside risk remains comparatively limited even during consolidation.

Trust with CoinPedia:

CoinPedia has been delivering accurate and timely cryptocurrency and blockchain updates since 2017. All content is created by our expert panel of analysts and journalists, following strict Editorial Guidelines based on E-E-A-T (Experience, Expertise, Authoritativeness, Trustworthiness). Every article is fact-checked against reputable sources to ensure accuracy, transparency, and reliability. Our review policy guarantees unbiased evaluations when recommending exchanges, platforms, or tools. We strive to provide timely updates about everything crypto & blockchain, right from startups to industry majors.

Investment Disclaimer:

All opinions and insights shared represent the author’s own views on current market conditions. Please do your own research before making investment decisions. Neither the writer nor the publication assumes responsibility for your financial choices.

Sponsored and Advertisements:

Sponsored content and affiliate links may appear on our site. Advertisements are marked clearly, and our editorial content remains entirely independent from our ad partners.

Earn more PRC tokens by sharing this post. Copy and paste the URL below and share to friends, when they click and visit Parrot Coin website you earn: https://parrotcoin.net0

PRC Comment Policy

Your comments MUST BE constructive with vivid and clear suggestion relating to the post.

Your comments MUST NOT be less than 5 words.

Do NOT in any way copy/duplicate or transmit another members comment and paste to earn. Members who indulge themselves copying and duplicating comments, their earnings would be wiped out totally as a warning and Account deactivated if the user continue the act.

Parrot Coin does not pay for exclamatory comments Such as hahaha, nice one, wow, congrats, lmao, lol, etc are strictly forbidden and disallowed. Kindly adhere to this rule.

Constructive REPLY to comments is allowed