Portugal is one of the oldest European countries. It was established as early as 1143. Lisbon is the capital of the country. It is a hub of tourism and infrastructure. The country’s economic status is advanced. It is a highly developed nation in all senses. It has a significant gold and lithium reserve. And, it is an active exporter. Interestingly, the country is always keen to embrace new technologies and business possibilities. Definitely, it is one of the reasons why it remains one of the most powerful economies in the world. Its attitude towards crypto is also positive in nature. It is one of Europe’s most crypto-friendly nations. From liberal tax frameworks, to supportive crypto policies, the nation offers everything a crypto enthusiast aspires to. Interesting? Read on!

1. Crypto Regulation in Portugal: An Overview

At present, there is no specific crypto regulation framework in Portugal. Anti-money laundering (AML) and counter-terrorist financing CFT) regulations are the main ones which regulate the crypto activities in the country right now. These regulations are actually guided by EU standards. Once the implementation of Markets in Crypto-Asset Regulation (MiCAR) – an effort by European Securities and Market Authority to establish uniform EU market rules for crypto-assets – is completed, the country’s crypto regulation framework will get more clarity. The Portuguese legal environment recently started adapting to EU initiatives. The DLT Pilot Regime, which allows for new market opportunities in trading and financial instruments on distributed ledger technology (DLT), was incorporated into the Portuguese law environment. In the country, crypto businesses have to follow a registration process. Banco de Portugal is the one which handles this registration process as well as the compliance of the registered companies with AML/CFT regulations. Any crypto translation over 1,000 euros is not possible for an entity, unless the required formalities, including the identification process, are addressed. The full implementation of MiCAR is expected to be completed by the end of this year. Certain sensitive areas, like sales and promotion, will remain in the grey zone, until then.

1.1. Markets in Crypto-Assets Regulation by European Securities and Markets Authority: Know It Better

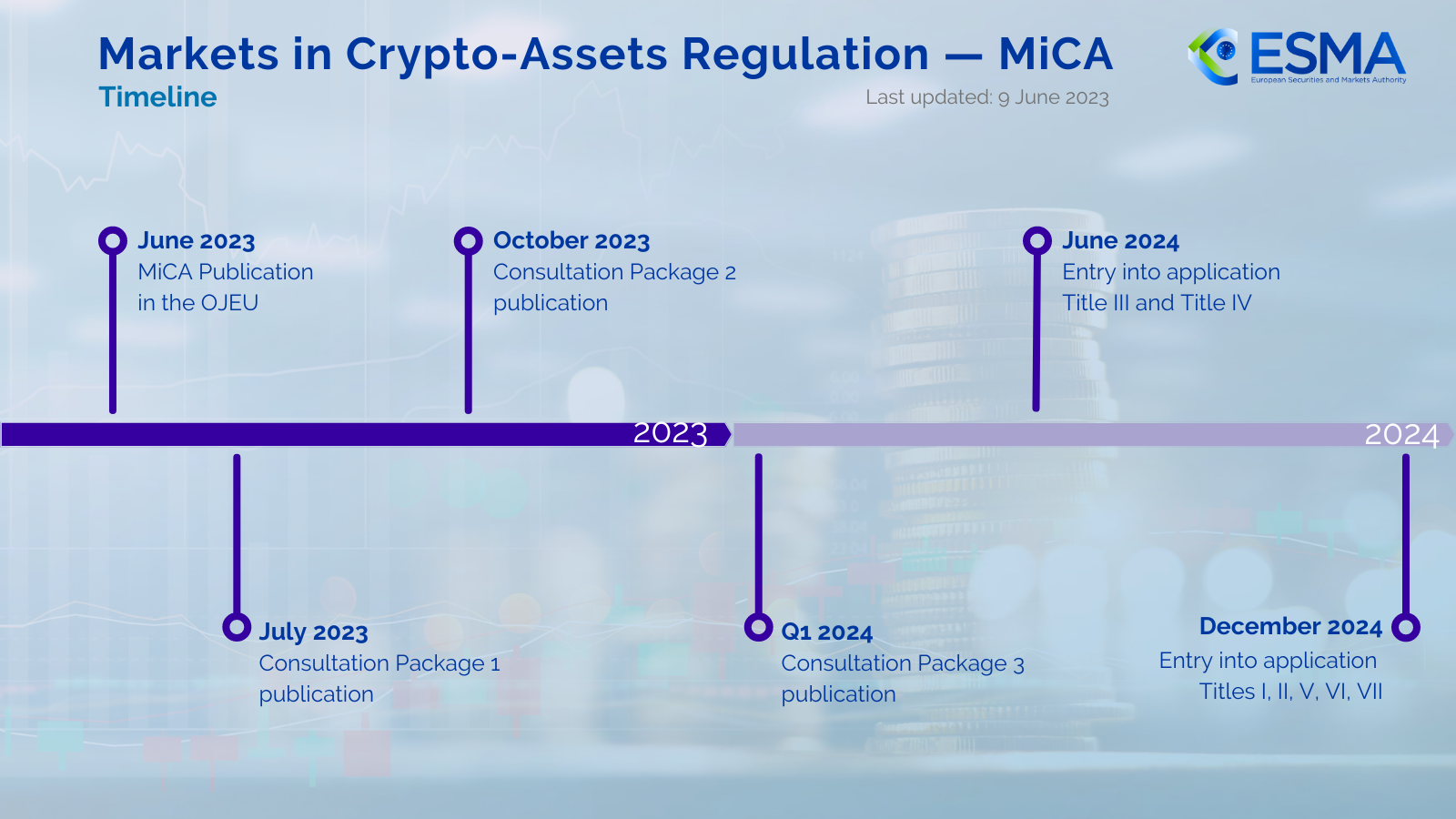

The Markets in Crypto-Assets Regulation (MiCA) is an important development in the European Union. It is effective from June 2023. Its prime goals are enhancing market integrity and financial stability. It considers creating policies for the better regulation of the issuance and trading of crypto-assets as one of the prime strategies to achieve it. It mandates transparency, disclosure, authorisation and supervision of transactions. The authority responsible for the implementation of MiCA is the European Securities and Markets Authority. At present, ESMA is developing technical standards through public consultations. MiCA is expected to come into force by the end of 2024.

2. Crypto Regulation in Portugal: What’s New

Here are the prime developments that happened this year in the crypto regulation landscape.

March 27, 2024: Worldcoin faced a temporary ban in Portugal due to data privacy issues.

April 12, 2024: The Nova SBE Blockchain Club organised the fourth Lisbon Blockchain Conference on April 24. The event explored the impact of blockchain technology on business and economy.

April 26, 2024: Operation Samourai led to the arrest of an American national in the Greater Lisbon area. He was suspected of co-founding the Bitcoin Mixer Samourai Wallet. The platform was allegedly involved in laundering over Euro 100 million.

3. Crypto Taxation Framework in Portugal Explained

Portugal is popular for its ‘tax-free’ policy. No capital gain taxes or VATs is applicable for individual investors.

For professional crypto traders or frequent/short-term traders, the scene is slightly different. Since January 1, 2023, a new tax regime has been in place under the Portuguese Personal Income Tax Code. The code categories crypto income into three distinct categories: Capital Income, Capital Gains, and Self-Employment Income.

Capital Income means the income from passive crypto investments – for example, the income from staking. This income attracts around 28%.

Capital Gains apply if you sell crypto held for less than a year. These gains are generally taxed at a flat 28% rate. But, if your taxable income, including these gains, exceeds Euro 78,834, the gains may be subjected to progressive tax rates. These rates range between 14.5% and 53%.

Self-Employment Income means the income from crypto-related self employment activities like mining. This also attracts progressive rates between 14.5% and 53%.

For businesses, the income from crypto operations is taxed as business income. If a business’ gross income from crypto operations was under Euro 200,000 in the previous year, 15% of this income is taxable at progressive rates after deductions.

A unique aspect of Portugal’s tax regime is the ‘Exit Tax.’ If you cease to be a tax resident, a 28% tax is applied on the difference between the market value and acquisition cost of your crypto assets. This is calculated using the First-In-First-Out (FIFO) method.

4. Crypto Mining in Portugal: What You Should Know

Crypto mining is not illegal in Portugal. Cryptocurrency mining in Portugal comes with specific tax rules.

For individual miners, a 5% fixed presumption of expenses is applied. If you earn Euro 100 from mining, you are taxed on only Euro 95. But if you sell the mined crypto, you are taxed on 85% of the income.

For businesses, 95% of the gross income from mining is taxable at progressive rates.

5. Timeline in Crypto Regulation Evolution in Portugal

2016: Cryptocurrencies ruled not legal tender; therefore untaxable.

August 2017: Law no. 83/2017 established to combat money laundering and terrorist financing.

July 2018: Law no. 38/2018 adopted MiFID II requirements for the sale and promotion of crypto assets.

April 2020: Digital Transition Action Plan published, promoting digital empowerment, business transformation, and flexible regulations for technology testing.

August 2020: Directive (EU) 2018/843 integrated into Law no. 83/2017, strengthening the country’s money laundering and terrorist financing combat framework.

August 2020: Banco de Portugal released a notice directing registration for virtual asset service providers.

December 2024: MiCAR is to be fully implemented.

Endnote

With its progressive crypto regulation framework and tax regime, Portugal stands out as a top destination for crypto enthusiasts. It is rightly celebrated as the most crypto-friendly country in Europe. The upcoming implementation of MiCAR promises to enhance this already robust framework. It is expected to foster an even friendlier environment for crypto activities. However, some grey areas and tax concerns remain, even if they are minor compared to other countries in the region. Portugal may address these issues in the coming years. Once it is done, the country can become a leader in the global crypto market, assuming a bigger role in the west

Also Check Out: Crypto Regulations in Switzerland 2024

Earn more PRC tokens by sharing this post. Copy and paste the URL below and share to friends, when they click and visit Parrot Coin website you earn: https://parrotcoin.net0

PRC Comment Policy

Your comments MUST BE constructive with vivid and clear suggestion relating to the post.

Your comments MUST NOT be less than 5 words.

Do NOT in any way copy/duplicate or transmit another members comment and paste to earn. Members who indulge themselves copying and duplicating comments, their earnings would be wiped out totally as a warning and Account deactivated if the user continue the act.

Parrot Coin does not pay for exclamatory comments Such as hahaha, nice one, wow, congrats, lmao, lol, etc are strictly forbidden and disallowed. Kindly adhere to this rule.

Constructive REPLY to comments is allowed